The Latest from Growpay

Growpays outlook on the future of payments.

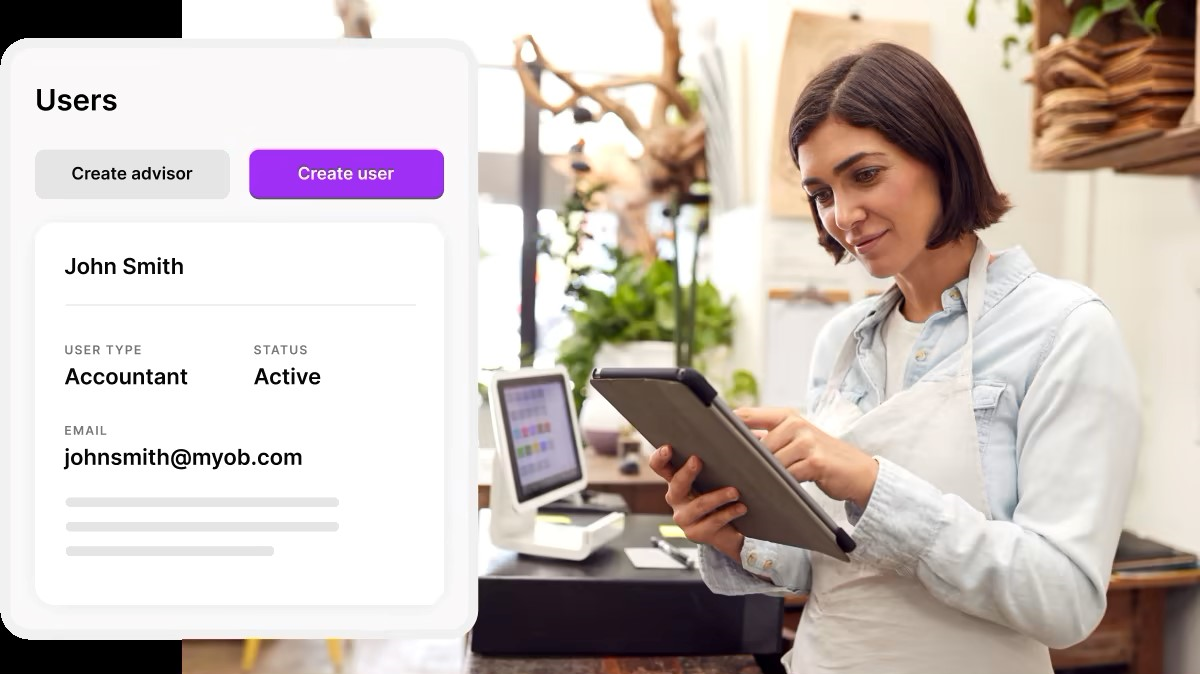

PayPal and MYOB Integrate to Offer BNPL and Faster Payments for SMEs

PayPal and MYOB have announced a new integration that will allow MYOB customers to accept payments via PayPal and PayPal Pay in 4. This is the first time that a Buy Now Pay Later (BNPL) service has been available within MYOB. The integration is expected to help businesses get paid faster and more securely, improving cashflow and reducing the burden of chasing and waiting for payments. For MYOB customers who have online invoice payments enabled, invoices will feature buttons for PayPal and PayP

How Businesses Can Benefit from the American Express and Envestnet | Yodlee Partnership

American Express and Envestnet | Yodlee have announced a new partnership that will offer American Express customers new digital banking options. The partnership will allow American Express customers to connect their accounts to thousands of third-party financial apps and services without having to share their account credentials. The partnership will use Envestnet | Yodlee's data aggregation and analytics platform to provide American Express customers with a secure and seamless way to connect t

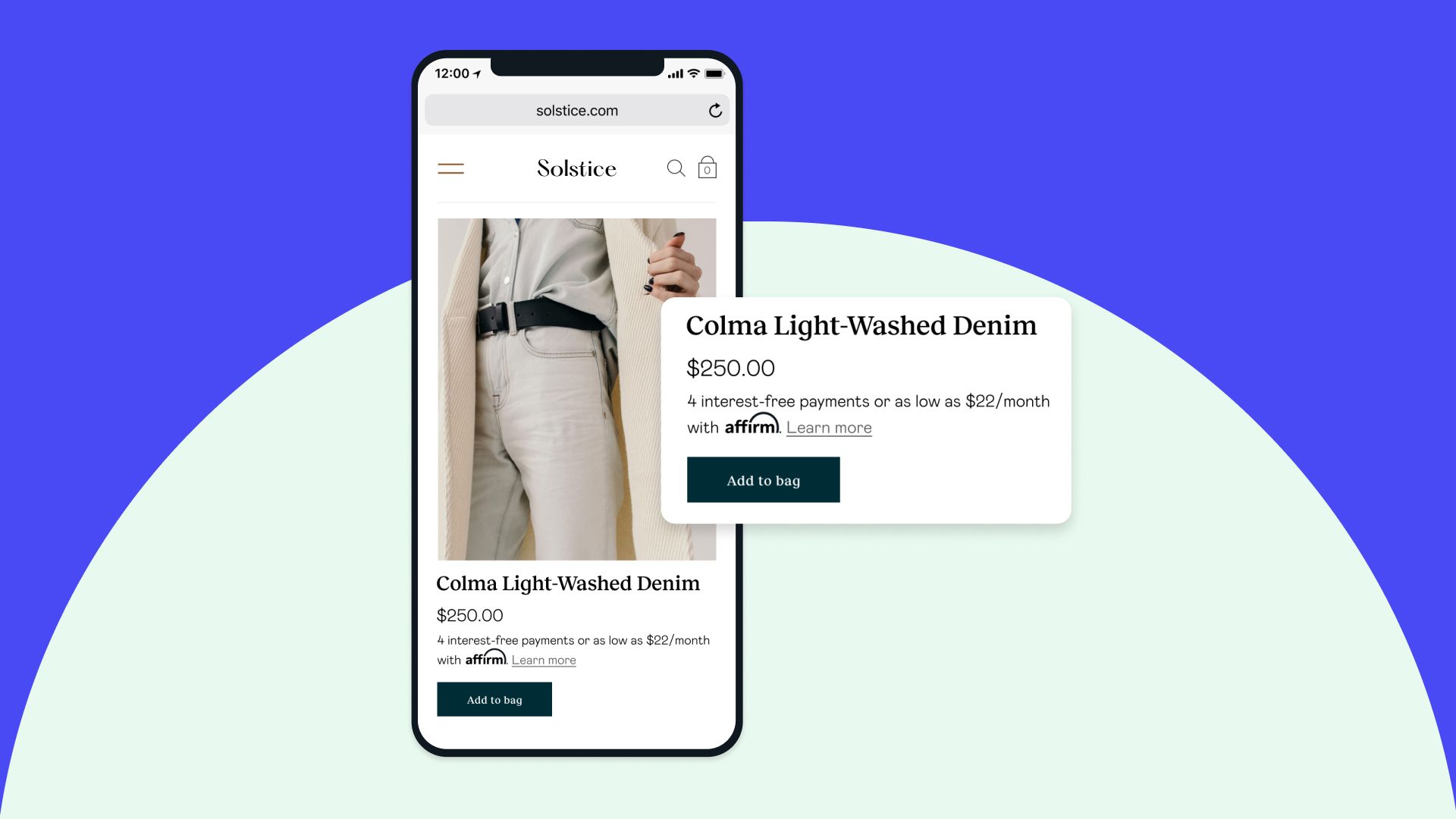

Amazon Pay Extends Buy Now Pay Later Partnership with Affirm in the US

Affirm, a buy now, pay later (BNPL) company, has expanded its partnership with Amazon Pay. As part of the new agreement, any Amazon Pay merchant in the U.S. can now offer Affirm as a payment option to their customers. Affirm's BNPL service allows customers to split the cost of a purchase into four equal payments, made every two weeks. There are no late fees or interest charges, as long as the payments are made on time. “We know customers want convenient and flexible payment options—whether the

Worldpay and Volt Partner to Bring Open Banking to Merchants Worldwide

Worldpay has partnered with Volt to provide merchants with account to account based payments. In a recent announcement, the two companies revealed that they are teaming up to bring open banking to merchants around the world. This partnership will give merchants access to a wide range of open banking features, including: * Account-to-account (A2A) payments: A2A payments allow customers to make payments directly from their bank accounts to a merchant's account. This is a fast, secure, and conven

Adyen Launches Payout Services to Improve Cash Flow for Businesses

Adyen, the global payments platform announced this week the launch of Payout Services, a new offering that enables businesses to payout acquired funds to their users or partners in the preferred method with increased velocity. With Payout Services, businesses can: * Payout funds to their users or partners in real time or within 24 hours, regardless of their location. * Choose from a variety of payout methods, including bank transfers, wallets, and gift cards. * Manage payouts globally with a s

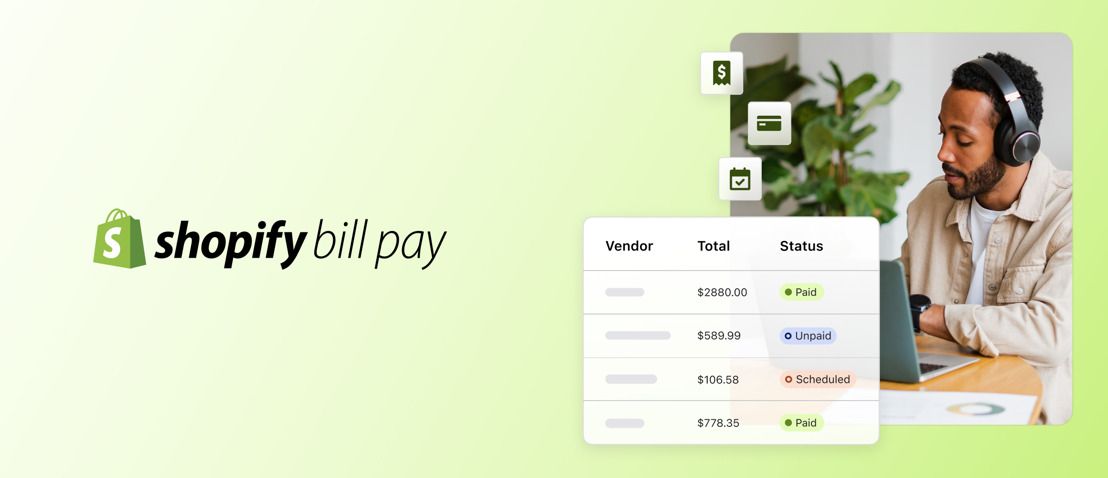

Shopify Bill Pay: A New Tool to Streamline Expense Management

Do you spend hours every month tracking down invoices, entering data, and making payments? If so, you're not alone. Managing expenses is a time-consuming task that can take away from running your business. It was announced last week that Shopify Bill Pay will save merchants up to 16 hours per month on paying business expenses, and is 2x faster than other businesses expenses management solutions. Through Shopify Bill Pay, Shopify continues to build a suite of embedded financial solutions that

How Stripe's Charge Card Program Can Help You Grow Your Business

Stripe, a financial infrastructure platform for businesses, announced yesterday a new charge card program for Stripe Issuing, Stripe’s commercial card issuing product. With the addition of charge cards, fintechs and platforms can create and distribute virtual or physical charge cards that allow their customers to spend on credit rather than the funds in their accounts—providing new revenue streams for platforms and allowing them to offer new financing capabilities to their customers. “Whether a

Worldpay and Affirm Team Up to Offer Buy Now, Pay Later

Worldpay, a global payments technology company, has partnered with Affirm, a buy now, pay later (BNPL) provider, to offer consumers a new way to pay for their purchases. Through the partnership, eligible Worldpay merchants will be able to offer Affirm's Adaptive Checkout solution, which allows customers to split their purchases into bi-weekly or monthly payments with no interest or late fees. "It's becoming increasingly important for merchants to provide pay-over-time payment solutions with con

Airwallex and TrueLayer Partner to Deliver Innovative Payment Solutions for Businesses

Airwallex, the leading global payments and financial platform for modern businesses, announced last week a partnership with TrueLayer, the payments network powered by open banking. The partnership will enable businesses to access a wider range of payment options, including real-time payments, and to improve their treasury operations. TrueLayer will leverage Airwallex's global payments and financial infrastructure API to build new products and services on a global scale. With this collaboration,