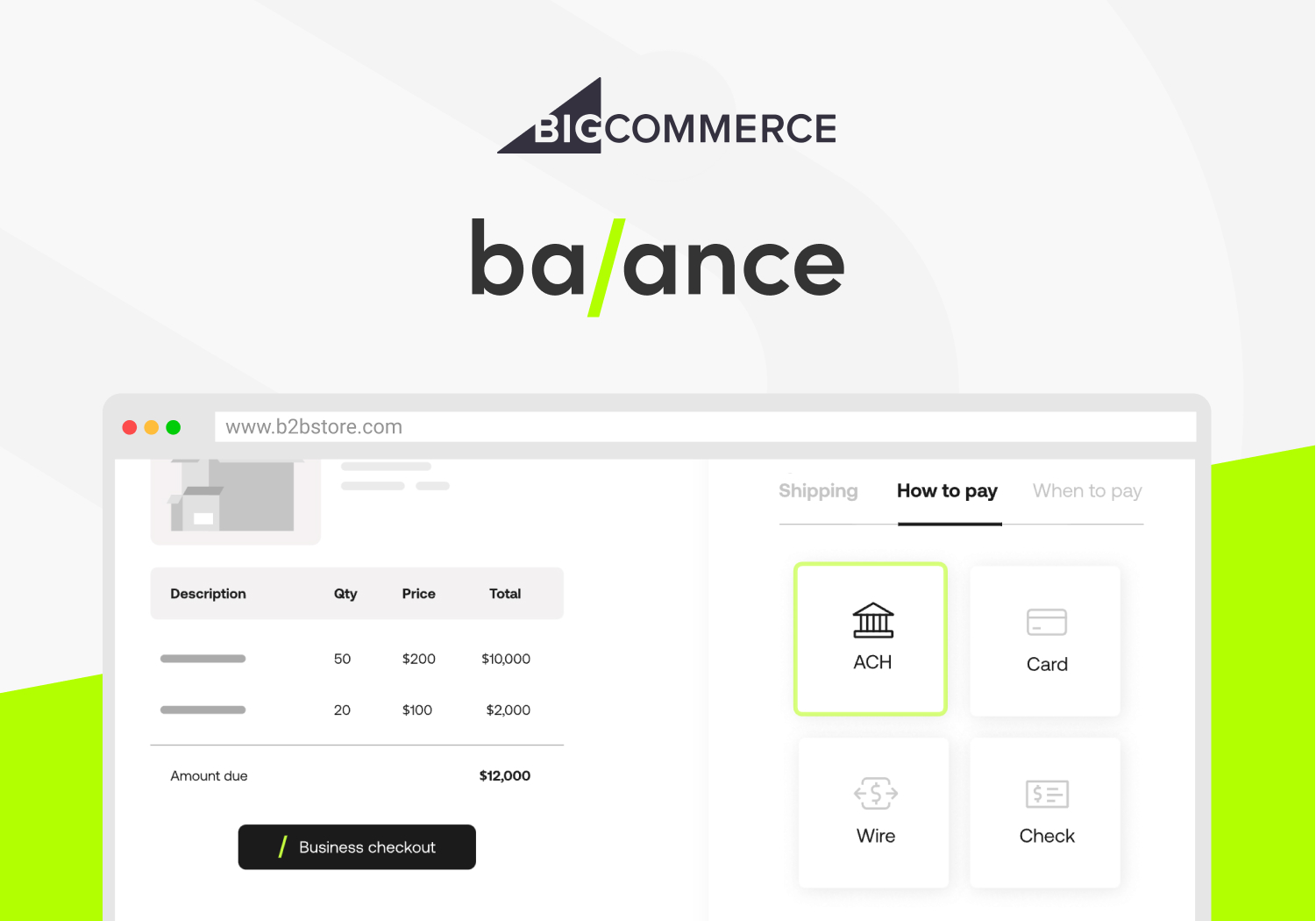

BigCommerce Partners with Balance to Improve B2B Payments

BigCommerce, a leading eCommerce platform, has partnered with Balance, a payments platform, to improve B2B payments. The partnership will give BigCommerce merchants access to Balance's digital and self-serve B2B payments solutions. Balance's solutions offer a variety of features that can help BigCommerce merchants improve their B2B payments experience, including: * Flexible payment terms - Balance offers a variety of payment terms, including net terms, which can help businesses manage their c

by Growpay

BigCommerce, a leading eCommerce platform, has partnered with Balance, a payments platform, to improve B2B payments. The partnership will give BigCommerce merchants access to Balance's digital and self-serve B2B payments solutions.

Balance's solutions offer a variety of features that can help BigCommerce merchants improve their B2B payments experience, including:

- Flexible payment terms - Balance offers a variety of payment terms, including net terms, which can help businesses manage their cash flow.

- Secure payments - Balance uses industry-leading security measures to protect customer data.

- Easy integration - Balance integrates seamlessly with BigCommerce, so merchants can start using its solutions right away.

The partnership between BigCommerce and Balance is a positive development for B2B merchants. By offering a more flexible and secure payment experience, Balance can help BigCommerce merchants attract and retain more customers.

In addition to the partnership with Balance, BigCommerce has also made a number of other moves to improve its B2B offerings in recent months. In January, the company launched an app that lets U.S. merchants put Amazon's Buy with Prime on their BigCommerce storefront with no coding needed. This app will help BigCommerce merchants target new "high-intent" shoppers and fuel greater conversions.

BigCommerce is clearly committed to providing its merchants with the tools they need to succeed in the B2B market. The partnerships with Balance and Amazon are just two examples of this commitment. As a result of these efforts, BigCommerce is well-positioned to continue to grow its B2B business in the years to come.

Benefits of the Partnership for BigCommerce Merchants

The partnership between BigCommerce and Balance offers a number of benefits for BigCommerce merchants, including:

- Improved payment experience - Balance's solutions offer a more flexible and secure payment experience than traditional B2B payment methods. This can help merchants attract and retain more customers.

- Increased sales - Balance's solutions can help merchants increase sales by making it easier for customers to pay for their purchases.

- Reduced costs - Balance's solutions can help merchants reduce costs by eliminating the need to process payments manually.

The partnership between BigCommerce and Balance is a positive development for B2B merchants. By offering a more flexible and secure payment experience, Balance can help BigCommerce merchants attract and retain more customers, increase sales, and reduce costs.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them