Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them

Zeller Launches Tap to Pay on Android, Boosting Business and Consumer Adoption

Great news for Australian businesses! Zeller, a fast growing payments company, has launched Tap to Pay on Android, making them the first homegrown fintech to offer this innovative contactless payment solution. This means businesses can now ditch the extra hardware and accept payments directly from their Android smartphones using the Zeller App. Faster Transactions, Happier Customers: The news comes on the heels of a successful Tap to Pay launch on iPhone in October 2023. Businesses have embra

Lightspeed Streamlines Operations for Retail and Restaurant Businesses

Lightspeed Commerce, a leading Point of Sale (POS) and payments platform for ambitious entrepreneurs, unveiled a suite of new features designed to help retailers and restaurants simplify operations, scale their business, and deliver exceptional customer experiences. “With inflation remaining a chief concern amongst hospitality and retail providers, Lightspeed has focused on innovations that improve speed and efficiency, reducing the overall time and stress related to daily business management,”

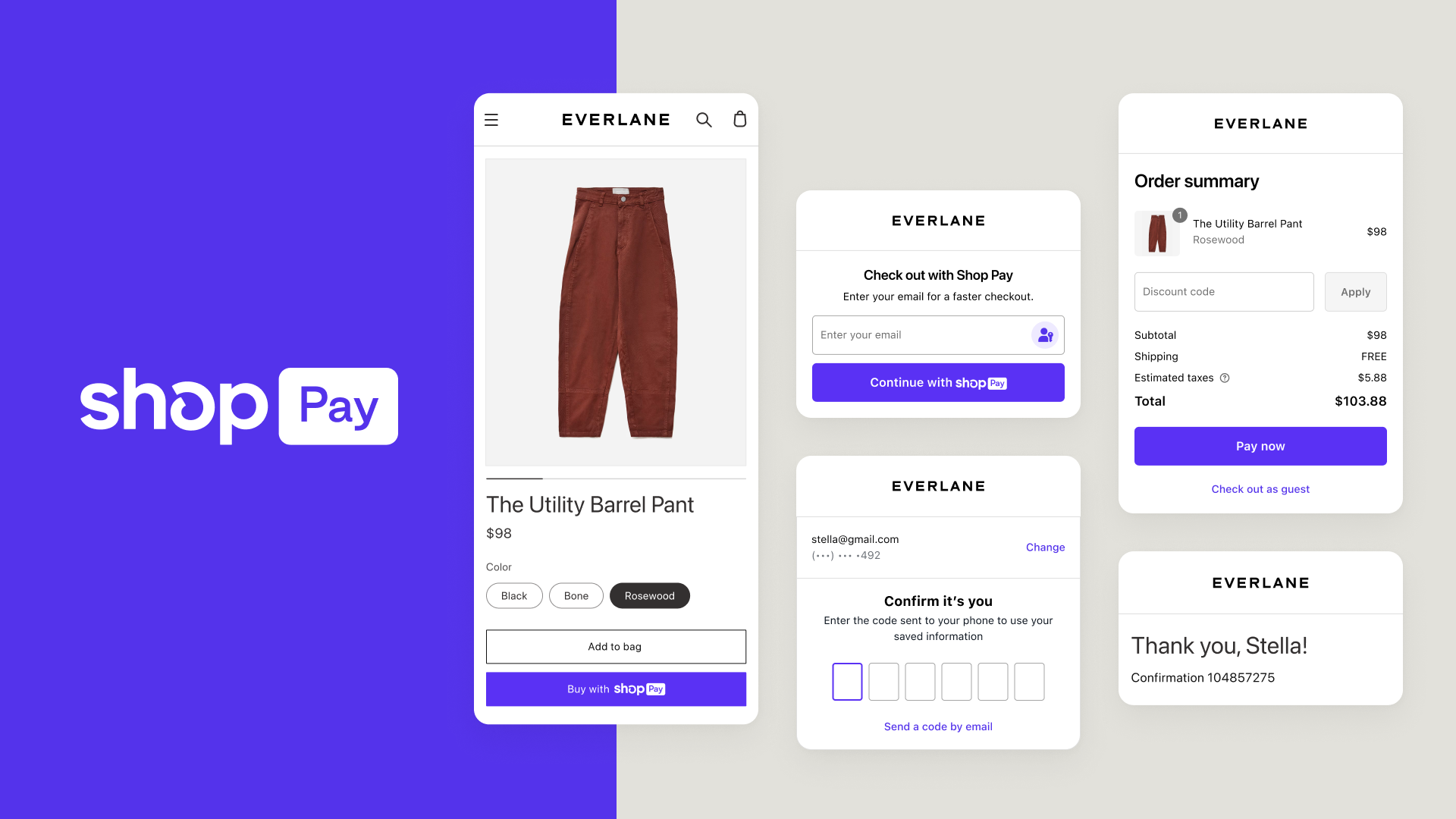

Shop Pay can now be Integrated with other Commerce Platforms.

Big news for online retailers! Shop Pay, the popular and fast-converting checkout solution from Shopify, is making its magic accessible to everyone. Previously limited to Shopify stores, Shop Pay is now available as a Commerce Component, allowing any business to integrate its seamless checkout experience into their existing platform, regardless of whether they use Shopify. This is a game-changer for businesses looking to boost conversion rates and improve customer satisfaction. Shop Pay has a p

Riskified Maximises Revenue Recovery for Businesses.

For online merchants, the post-holiday season often brings not just cheer, but also a dreaded surge in chargebacks. Battling payment disputes can be a time-consuming, manual grind, eating into profits and leaving valuable resources drained. But fear not, for Riskified has arrived with a mighty weapon; an expanded chargeback management system that promises to revolutionise the game. Introducing Dispute Resolve: Your Chargeback-Crushing Ally Imagine a world where disputing chargebacks is effort

What the Airwallex x Woo Partnership means for Merchants

Woo, the leading open-source ecommerce platform, just announced a partnership with Airwallex, a global payments and financial platform. This means WooCommerce stores can now accept cross-border payments seamlessly, opening up a world of new customers and sales opportunities. Here's what it means for Woo merchants: * Reach millions more shoppers - With Woo powering over 3.5 million stores, you'll have access to a vast audience of potential customers around the globe. * Simplify cross-border

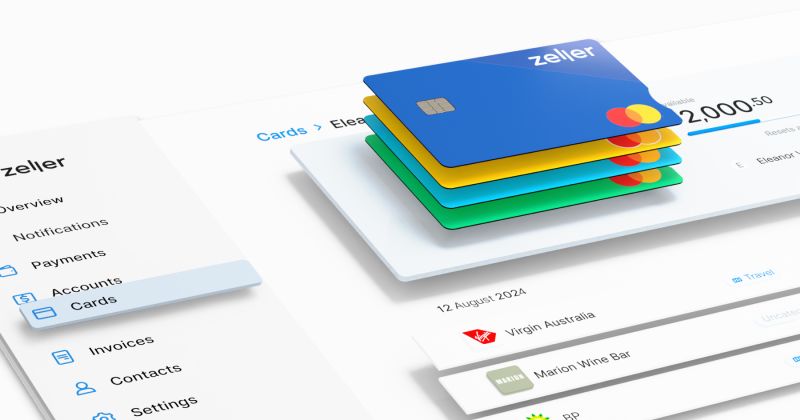

Zeller Launches Corporate Cards for Businesses.

In the dynamic world of business, efficient expense management is crucial for maintaining financial stability and growth. Zeller, a leading Australian FinTech, has introduced Zeller Corporate Cards, a revolutionary solution that addresses the prevailing pain points in existing expense management offerings and caters to the evolving needs of Australian businesses. A Versatile Payment Solution for Diverse Business Needs Zeller Corporate Cards offer versatility in application, extending beyond i

Gr4vy and Waave Partner to Shape the Future of Australian Retail Payments

Gr4vy and Waave have joined forces to revolutionise the Australian retail payment landscape. The two companies are collaborating to introduce a new "Pay by Bank" solution that will offer merchants a range of benefits, including reduced transaction costs, enhanced security, and improved customer experience. What is Pay by Bank? Pay by Bank is an innovative payment method that allows customers to make payments directly from their bank accounts. This eliminates the need for card details to be sh

Weel improves its Bill Payment Experience for Businesses

Weel, a leading Australian Expense Management software provider, has recently unveiled a series of updates to its bill payment product that are set to revolutionise the way businesses manage their accounts payable (AP). These innovative features promise to cut AP processing time in half, enhance security around invoice payments, and provide a host of benefits to merchants. A Huge Win for Bookkeepers and AP Teams For bookkeepers and AP teams, Weel's new bill payment experience is a game-change

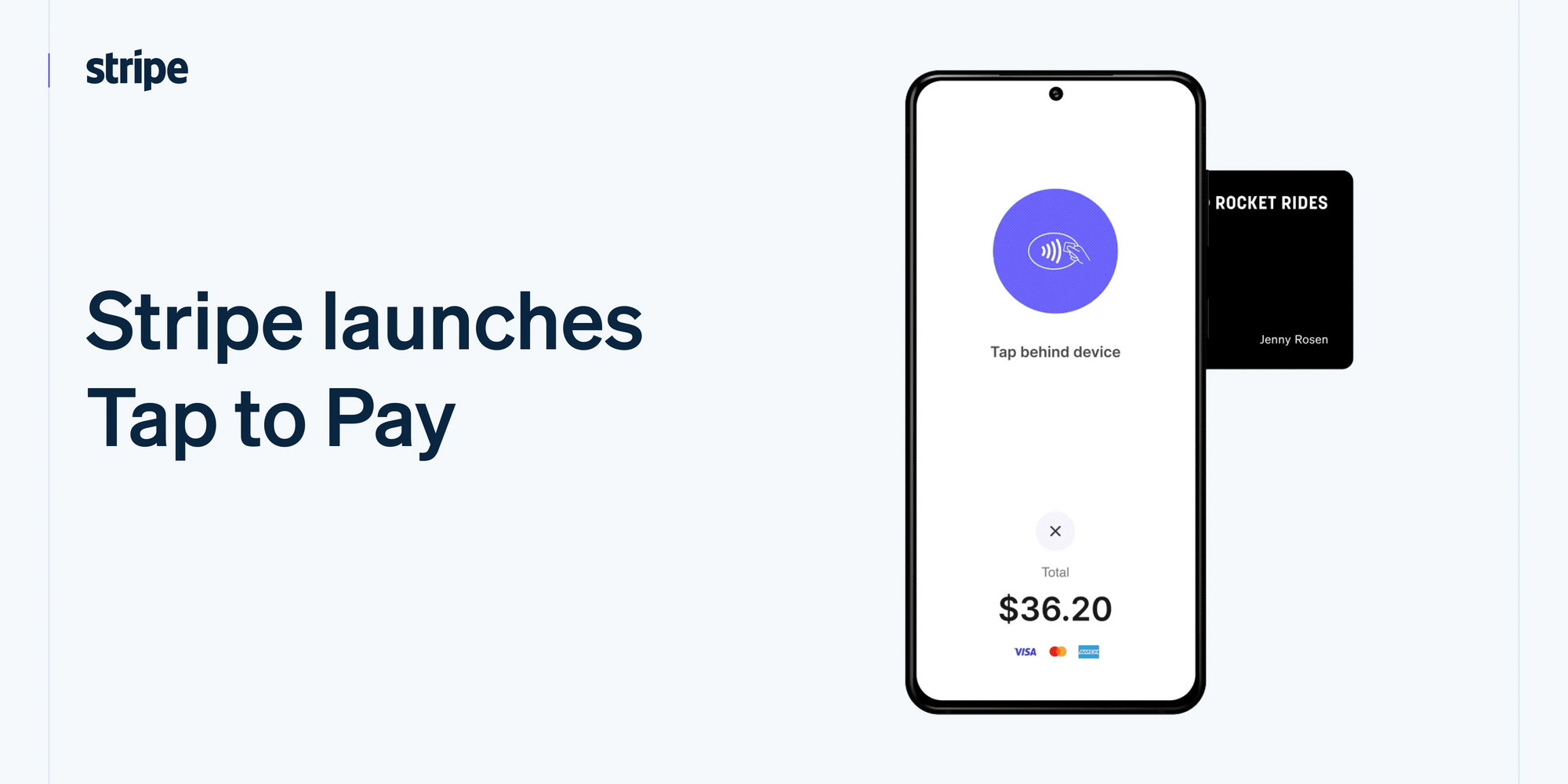

Accepting Payments with Stripe Tap to Pay

Stripe, a popular payment processing platform, has recently announced that businesses can now accept payments with Tap to Pay directly via the Stripe app. This is a major development for businesses of all sizes, as it makes it easier and more convenient to accept in-person payments. How Stripe Tap to Pay Works Tap to Pay is a contactless payment technology that allows customers to pay for goods or services by tapping their phone or contactless card on a payment terminal. It is a secure and co

Mr Yum & me&u merge to improve the hospitality industry.

In a move that has been hailed as a "win for the industry," two leading hospitality technology companies, Mr Yum and me&u (meandu), have merged to create a single, unified platform that will provide businesses and their customers with an unparalleled suite of tools and services. The merger brings together two of the most respected names in the industry, with Mr Yum known for its innovative mobile ordering platform and me&u renowned for its comprehensive suite of sales and marketing solutions. T

Hello Clever and Flagright Partner to Boost Real-Time Payment Security in Australia.

Exciting news for Australian businesses! Leading fintech company Hello Clever and global AML compliance solutions provider Flagright have announced a strategic partnership to enhance the security of Hello Clever's real-time payments platform. This collaboration aims to empower businesses with a safer and more reliable payments experience. Caroline Tran, CEO of Hello Clever, stated: "Partnering with Flagright reinforces our commitment to providing the most secure real-time payment solution for o

NAB launches digital wallet-enabled virtual corporate cards

NAB has announced today the launch of its digital wallet enabled virtual corporate cards. NAB corporate cards can help businesses streamline, modernise, and simplify their expenses. It allows businesses to create virtual cards on demand for employees and contractors to use in apps, online, or in store, no matter their location. Additionally, these cards can be used with digital wallets such as Apple Pay or Google Pay. “There’s one thing our customers can never get enough of – time. So, we’re r