PayPal and MYOB Integrate to Offer BNPL and Faster Payments for SMEs

PayPal and MYOB have announced a new integration that will allow MYOB customers to accept payments via PayPal and PayPal Pay in 4. This is the first time that a Buy Now Pay Later (BNPL) service has been available within MYOB. The integration is expected to help businesses get paid faster and more securely, improving cashflow and reducing the burden of chasing and waiting for payments. For MYOB customers who have online invoice payments enabled, invoices will feature buttons for PayPal and PayP

by Growpay

PayPal and MYOB have announced a new integration that will allow MYOB customers to accept payments via PayPal and PayPal Pay in 4. This is the first time that a Buy Now Pay Later (BNPL) service has been available within MYOB.

The integration is expected to help businesses get paid faster and more securely, improving cashflow and reducing the burden of chasing and waiting for payments.

For MYOB customers who have online invoice payments enabled, invoices will feature buttons for PayPal and PayPal Pay in 4. This will allow payers to pay instantly, or divide the payment over four interest-free instalments, with no late fees.

The integration is expected to be a boon for small businesses, which often struggle with cashflow. Research commissioned by PayPal showed almost half of Australian businesses (44%) view cashflow as their greatest challenge.

These findings highlight the importance of cashflow for SMEs. By providing businesses with a faster and more convenient way to get paid, the PayPal and MYOB integration can help to address this challenge and improve the financial health of SMEs.

“Customers expect seamless and convenient payment experiences when shopping online, but that expectation is expanding to anywhere they need to make a payment,” said Jonathan Han, Director, Channel Partnerships and Small Businesses, PayPal.

“Just as we see customers abandon shopping carts when their preferred payment option isn’t available, or when they hit friction in the payment process, many customers will put off paying an invoice if they can’t do so quickly and conveniently with the device they have on hand.”

The integration is also expected to be popular with consumers, who are increasingly using BNPL services. Research by MYOB showed two thirds of respondents (66%) said they do not currently offer BNPL, meaning this integration could help many provide the service to their customers for the first time.

“Small and medium enterprises face significant economic challenges following a tough few years, so prompt payments and healthy cashflow could not be more important,” said Andrew Baines, General Manager of Financial Services at MYOB.

“Offering the options to pay with PayPal, or PayPal Pay in 4, gives customers every opportunity to pay on time, while improving their experience and deepening their relationship with the business they’re paying.”

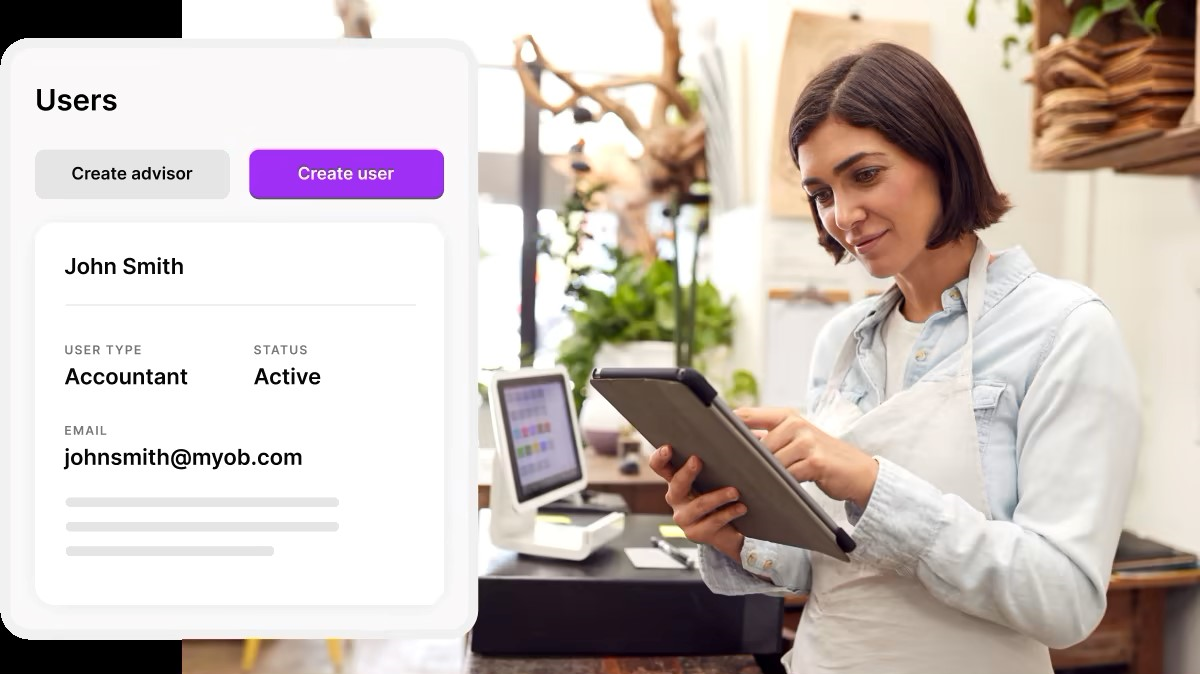

How the integration works

For MYOB customers who have online invoice payments enabled, invoices will feature buttons for PayPal and PayPal Pay in 4. Payers can then choose to pay instantly with PayPal, or divide the payment over four interest-free instalments with PayPal Pay in 4.

Benefits of the integration

The integration offers a number of benefits for both businesses and customers, including:

- Increased convenience and flexibility for customers, who can now pay for invoices in the way that suits them best.

- Faster payments for businesses, which can help to improve cashflow and reduce the burden of chasing late payments.

- A wider range of payment options for businesses, which can help them to attract and retain customers.

The integration is now available to MYOB customers in Australia.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them