Why Businesses Need Recurring Billing Software in 2024

In today's fast-paced business environment, businesses are constantly looking for ways to optimize their processes and improve their bottom line. One area where efficiency can be greatly enhanced is in billing and payment management. Recurring billing software offers a powerful solution for businesses that have recurring revenue streams, such as subscription-based services or membership programs. With the ability to automate invoicing, manage subscriptions, and integrate with multiple payment g

by Growpay

In today's fast-paced business environment, businesses are constantly looking for ways to optimize their processes and improve their bottom line. One area where efficiency can be greatly enhanced is in billing and payment management.

Recurring billing software offers a powerful solution for businesses that have recurring revenue streams, such as subscription-based services or membership programs. With the ability to automate invoicing, manage subscriptions, and integrate with multiple payment gateways, recurring billing software can streamline your payment processes and improve customer retention.

In this blog post, we will explore why businesses need recurring billing software and the key features to look for when selecting a solution. We will also provide practical insights on how to implement recurring billing software in your business and share real-life case studies of successful implementation.

Why Businesses Need Recurring Billing Software Managing recurring payments manually can be time-consuming and prone to errors. Recurring billing software offers several benefits that can greatly alleviate these challenges:

- Streamlining Payments - By automating the billing process, recurring billing software ensures that invoices are sent out on time and payments are collected promptly. This not only saves time but also minimizes the risk of missed or late payments.

- Improving Customer Retention - With recurring billing software, businesses can easily manage subscriptions and offer flexible payment options to their customers. This enhances the customer experience and improves retention rates, leading to increased revenue over time.

- Reducing Errors and Fraud - Manual billing processes are susceptible to human errors and fraudulent activities. Recurring billing software incorporates security measures and validation checks to reduce the risk of errors and protect businesses from fraudulent transactions.

Key Features to Look for in Recurring Billing Software When choosing a recurring billing software solution, it is important to consider the following key features:

- Automated Invoicing - Look for software that can generate and send invoices automatically based on predefined schedules. This feature saves time and ensures accurate and timely invoicing.

- Multiple Payment Gateways - Ensure that the software supports integration with multiple payment gateways, allowing customers to make payments through their preferred methods.

- Subscription Management - Look for a solution that offers robust subscription management capabilities, including the ability to add, modify, and cancel subscriptions easily.

- Reporting and Analytics - The software should provide comprehensive reporting and analytics features, allowing businesses to gain insights into revenue trends, customer behavior, and other key metrics.

How to Implement Recurring Billing Software in Your Business Implementing recurring billing software in your business requires careful planning and execution. Here are the steps to follow:

- Assessing Your Business Needs - Evaluate your current billing processes and identify pain points that can be addressed by recurring billing software. Determine your specific requirements and goals.

- Choosing the Right Software - Research and compare different recurring billing software solutions to find the one that best fits your business needs. Consider factors such as features, pricing, scalability, and customer support. Online marketplaces such as Growpay can be a great alternative payment resource to easily compare and discover top recurring billing software solutions. Some popular recurring billing providers include include Chargebee, Wave, Recurly and Stripe Billing.

- Integrating the Software with Existing Systems - Ensure that the chosen software can seamlessly integrate with your existing systems, such as CRM or accounting software. This will streamline your overall operations.

- Training Staff and Educating Customers - Provide adequate training to your staff on how to use the recurring billing software effectively. Educate your customers about the new payment processes and address any concerns they may have.

Recurring billing software is a game-changer for businesses that rely on recurring revenue streams. By automating invoicing, streamlining payments, and improving customer retention, businesses can enhance their efficiency and profitability. In the upcoming sections, we will dive deeper into each aspect of recurring billing software implementation, providing you with practical insights and actionable steps. Stay tuned!

Introduction to Recurring Billing Software

Recurring billing software is a powerful tool that enables businesses to automate their billing processes for recurring revenue streams. It offers a comprehensive solution for managing subscriptions, membership programs, and other recurring payments. In this section, we will provide an introduction to recurring billing software, explaining its purpose, benefits, and how it works.

What is Recurring Billing Software?

Recurring billing software is a specialized software solution designed to automate and streamline the recurring billing process. It allows businesses to set up recurring invoices, manage subscriptions, and collect payments from customers on a regular basis. This software eliminates the need for manual invoicing and payment collection, saving time and reducing the risk of errors.

The Purpose of Recurring Billing Software

The primary purpose of recurring billing software is to simplify and optimize the billing process for businesses that have recurring revenue streams. It offers a range of features and functionalities that enable businesses to manage their subscriptions, recurring services, or products efficiently. By automating the invoicing and payment collection process, businesses can focus more on delivering value to their customers and growing their business.

Benefits of Recurring Billing Software

Implementing recurring billing software can bring numerous benefits to businesses of all sizes. Some of the key advantages include:

- Time and Cost Savings - Automating the billing process eliminates the need for manual data entry and reduces the time and effort required for invoicing and payment collection. This, in turn, can lead to significant cost savings in terms of labor and resources.

- Improved Cash Flow - By automating the payment collection process, recurring billing software ensures a steady and predictable cash flow for businesses. This is particularly beneficial for businesses with subscription-based models or recurring service contracts.

- Enhanced Customer Experience - Recurring billing software enables businesses to offer flexible payment options to their customers. Customers can easily set up recurring payments, reducing the hassle of manual payments and ensuring a seamless and convenient experience.

- Reduced Errors and Disputes - Manual billing processes are prone to errors and disputes. With recurring billing software, businesses can minimize the risk of billing inaccuracies, reduce payment disputes, and maintain better relationships with their customers.

How Recurring Billing Software Works

Recurring billing software typically operates through a cloud-based platform or an on-premises server. It integrates with other business systems such as CRM or accounting software to streamline the billing process. Here's a brief overview of how recurring billing software works:

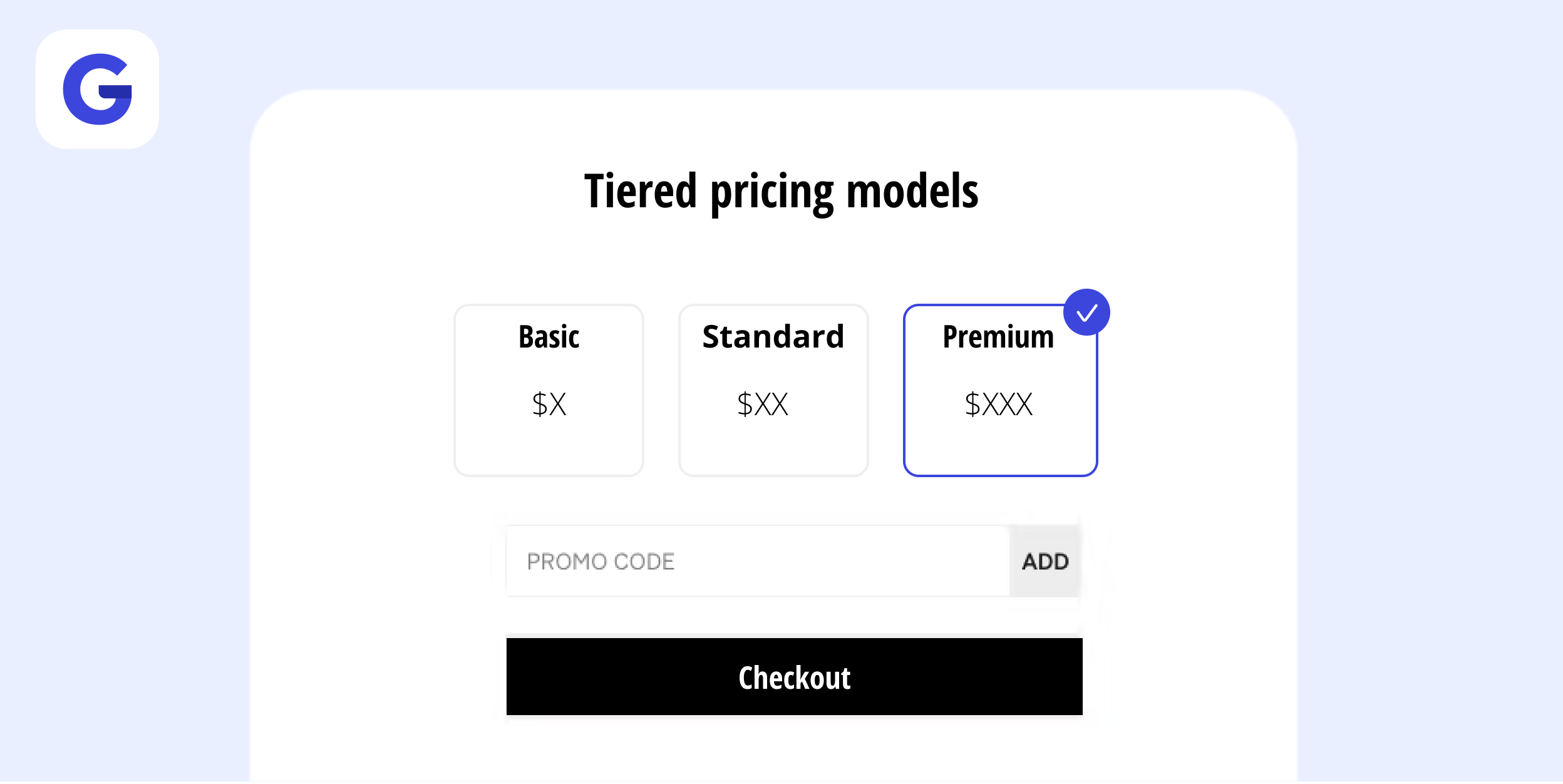

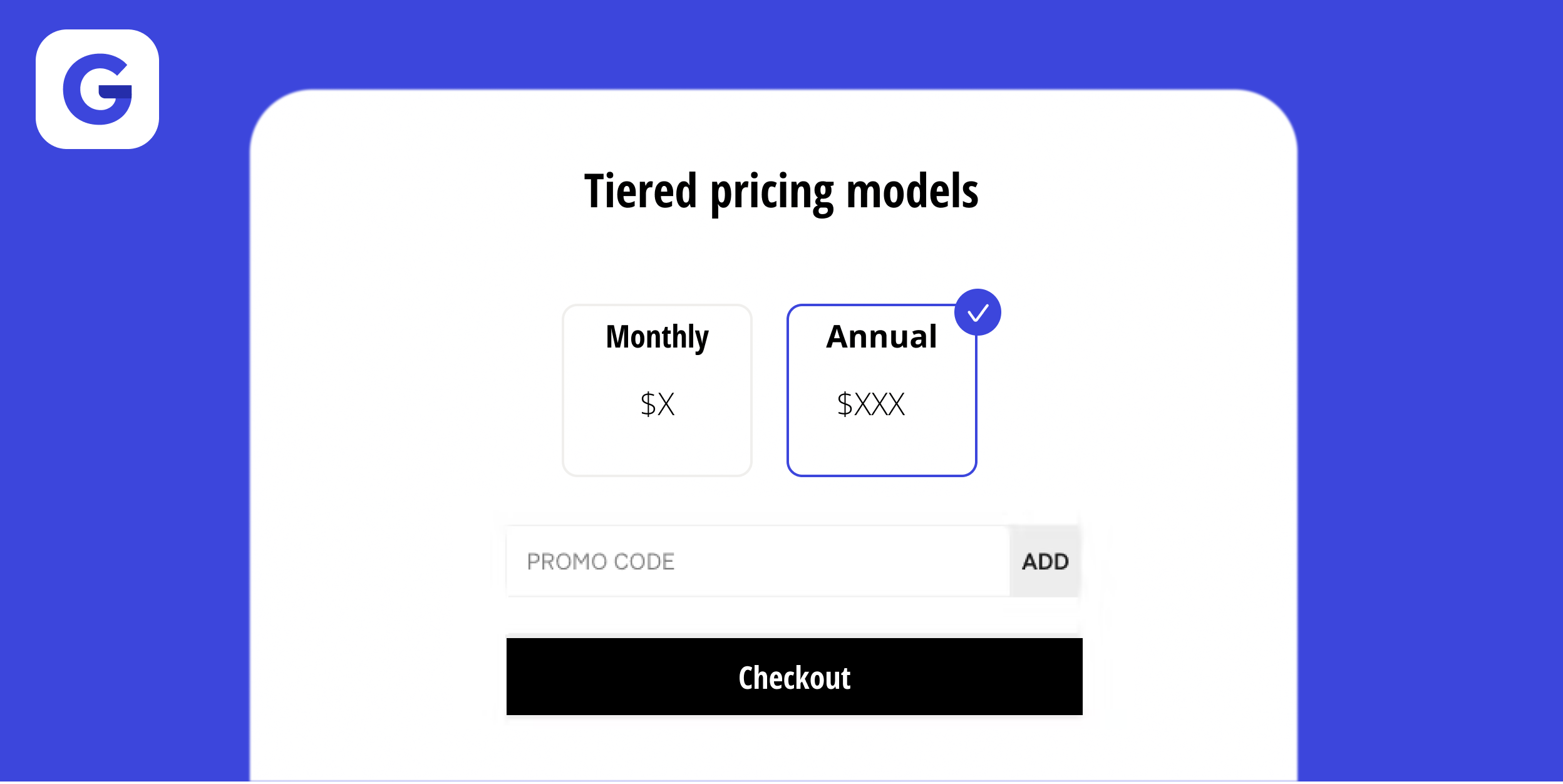

- Subscription Setup - Businesses can define their subscription plans, including pricing, billing frequency, and any additional features or services. Customers can then choose the subscription plan that suits their needs.

- Invoicing and Payment Collection - The software automatically generates and sends invoices to customers based on the defined billing frequency. It also facilitates payment collection through various payment gateways, such as credit cards, ACH, or digital wallets.

- Subscription Management - Businesses can manage their subscriptions, including adding or removing subscribers, modifying subscription details, and handling upgrades or downgrades. The software keeps track of all subscription-related activities.

- Reporting and Analytics - Recurring billing software provides comprehensive reporting and analytics features, allowing businesses to gain insights into revenue trends, customer behavior, churn rates, and other key metrics. This data can inform business decisions and help optimize subscription management strategies.

Recurring billing software is a valuable tool for businesses that rely on recurring revenue streams. By automating the billing process, businesses can save time, improve cash flow, enhance the customer experience, and reduce errors. In the next section, we will delve deeper into why businesses need recurring billing software, exploring the specific benefits it offers in more detail.

Why Businesses Need Recurring Billing Software

Recurring billing software is becoming increasingly essential for businesses that have recurring revenue streams. In this section, we will explore the reasons why businesses need recurring billing software and the specific benefits it offers.

Streamlining Payments

One of the primary reasons why businesses need recurring billing software is to streamline their payment processes. Manual billing and payment collection can be time-consuming and prone to errors. With recurring billing software, businesses can automate the entire invoicing and payment collection process. This ensures that invoices are generated and sent out on time, and payments are collected promptly, reducing the risk of missed or late payments.

By streamlining payments, businesses can save valuable time and resources that can be allocated towards more important tasks, such as delivering high-quality products or services to their customers. Additionally, automated payment processes help improve cash flow, providing a steady and predictable revenue stream for the business.

Improving Customer Retention

Recurring billing software plays a crucial role in improving customer retention. With the ability to manage subscriptions and offer flexible payment options, businesses can enhance the overall customer experience. Customers appreciate the convenience of automated recurring payments, as it eliminates the need for manual payments and ensures that their subscriptions or services are uninterrupted.

Moreover, recurring billing software allows businesses to easily handle upgrades, downgrades, or cancellations of subscriptions. This flexibility in managing subscriptions can help businesses meet the changing needs of their customers and increase customer satisfaction. By providing a seamless and hassle-free billing experience, businesses can improve customer retention rates and foster long-term relationships with their clientele.

Reducing Errors and Fraud

Manual billing processes are prone to errors and can be susceptible to fraudulent activities. Recurring billing software incorporates advanced security measures and validation checks to minimize the risk of errors and protect businesses from fraudulent transactions.

By automating the billing process, businesses can significantly reduce the chances of billing inaccuracies, such as incorrect amounts or incorrect customer information. This not only helps maintain the integrity of the billing system but also ensures that customers are billed accurately, avoiding disputes or dissatisfaction.

Furthermore, recurring billing software often includes features like PCI compliance and encryption to secure sensitive customer data during payment transactions. This helps businesses build trust with their customers and safeguards their financial information from potential fraud or data breaches.

Businesses need recurring billing software to streamline their payment processes, improve customer retention, and reduce errors and fraud. The next section will delve into the key features to look for when selecting a recurring billing software solution, providing businesses with valuable insights to make informed decisions.

Key Features to Look for in Recurring Billing Software

When selecting a recurring billing software solution for your business, it is important to consider the key features that will meet your specific needs. In this section, we will explore the essential features to look for in recurring billing software to ensure an efficient and effective billing process.

Automated Invoicing

One of the core features of recurring billing software is automated invoicing. This feature enables businesses to generate and send invoices automatically based on predefined schedules. The software should have the capability to customize invoice templates, include relevant billing details, and support multiple currencies if necessary. Automated invoicing saves time and ensures accurate and timely invoicing, reducing the risk of billing errors and improving cash flow.

Multiple Payment Gateways

A crucial feature to consider is the ability of the recurring billing software to integrate with multiple payment gateways. This allows businesses to offer a variety of payment options to their customers, such as credit cards, ACH, and digital wallets. By supporting multiple payment gateways, businesses can cater to the preferences of their customers, providing a seamless and convenient payment experience. It is important to check that the software supports the payment gateways that are commonly used in your target market.

Subscription Management

Effective subscription management is another key feature to look for in recurring billing software. The software should provide robust functionality to manage subscriptions, including the ability to add, modify, and cancel subscriptions easily. Businesses should be able to set up different subscription plans, define pricing tiers, and handle upgrades or downgrades seamlessly. Advanced features like proration, trial periods, and customizable billing cycles can also enhance subscription management capabilities.

Reporting and Analytics

Comprehensive reporting and analytics capabilities are essential for businesses to gain insights into their recurring revenue streams. The recurring billing software should provide detailed reports on revenue trends, customer behavior, churn rates, and other key metrics. These insights can help businesses make data-driven decisions, optimize subscription management strategies, and identify areas for improvement. Look for software that offers customizable reporting options and integrates with business intelligence tools for advanced analytics.

Integration Capabilities

When selecting recurring billing software, consider its integration capabilities with other business systems. Integration with Customer Relationship Management (CRM) software, accounting software, or other relevant tools can streamline operations and ensure data consistency across different platforms. This allows for seamless communication between systems, reduces manual data entry, and enhances overall efficiency.

When choosing recurring billing software for your business, it is important to prioritize key features that align with your specific needs. Automated invoicing, multiple payment gateways, subscription management capabilities, robust reporting and analytics, and integration capabilities are essential features to look for. By selecting a software solution that encompasses these features, businesses can efficiently manage their recurring revenue streams and optimize their billing processes. In the next section, we will delve into the implementation process of recurring billing software, providing practical insights on how to successfully integrate it into your business operations.

How to Implement Recurring Billing Software in Your Business

Implementing recurring billing software in your business requires careful planning and execution. In this section, we will guide you through the steps involved in successfully implementing recurring billing software.

Assessing Your Business Needs

Before implementing recurring billing software, it is crucial to assess your business needs and understand the specific requirements you have. Consider factors such as the volume of recurring transactions, the complexity of your subscription models, the desired level of automation, and any specific integration requirements with existing systems. By conducting a thorough assessment, you can determine the features and functionalities that are essential for your business and make an informed decision when selecting a software solution.

Choosing the Right Software

Selecting the right recurring billing software is crucial for a successful implementation. Research and evaluate different software options, considering factors such as features, scalability, pricing, customer support, and user reviews. Look for software that aligns with your business needs and goals, and consider conducting trials or demos to get a hands-on experience before making a final decision. It is also beneficial to seek recommendations from other businesses in your industry who have implemented recurring billing software.

Integrating the Software with Existing Systems

Once you have chosen the recurring billing software, the next step is to integrate it with your existing systems. Determine which systems, such as CRM or accounting software, need to be integrated with the billing software to ensure seamless data flow. Check if the software provides APIs or integration tools that facilitate integration with other platforms. Work closely with your IT team or consultants to ensure a smooth integration process and test the integration thoroughly to ensure data accuracy and consistency.

Training Staff and Educating Customers

Proper training and education are essential for a successful implementation of recurring billing software. Train your staff on how to use the software effectively, including generating invoices, managing subscriptions, and handling customer inquiries or issues. Ensure that they are familiar with the software's features and functionalities to maximize its benefits. Additionally, educate your customers about the new payment processes, such as setting up recurring payments or accessing their billing information online. Provide clear instructions and support channels for any questions or concerns they may have.

Ongoing Monitoring and Optimization

Implementing recurring billing software is not a one-time process. It is important to continuously monitor the system's performance and make necessary adjustments or optimizations as needed. Regularly review reports and analytics provided by the software to identify any issues or areas for improvement. Seek feedback from your staff and customers to gauge their satisfaction with the new billing system and make adjustments accordingly. Stay updated with software updates and new features to ensure you are leveraging the full potential of the recurring billing software.

Implementing recurring billing software in your business requires a strategic approach. By assessing your business needs, choosing the right software, integrating it with existing systems, training staff, and educating customers, you can successfully implement recurring billing software and streamline your billing processes. Ongoing monitoring and optimization will ensure that you continue to maximize the benefits of the software. In the next section, we will explore real-life case studies of businesses that have successfully implemented recurring billing software, providing valuable insights and inspiration.

Businesses across various industries have experienced improved efficiency, enhanced customer satisfaction, and increased revenue through the implementation of recurring billing software. By automating invoicing, managing subscriptions, and offering flexible payment options, businesses can streamline their billing processes and focus on delivering value to their customers.

Implementing recurring billing software requires careful consideration of business needs, choosing the right software, integrating with existing systems, and providing adequate training and education to staff and customers. By leveraging the insights and experiences shared in these case studies, businesses can gain inspiration and guidance for their own successful implementation of recurring billing software.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Understanding Subscription Billing Solutions

Subscription billing has become increasingly popular in recent years, with more and more businesses adopting this model to offer their products or services. From streaming platforms to software companies, subscription-based business models have proven to be successful and profitable. However, managing subscription billing can be complex and time-consuming without the right solution in place. In this blog post, we will dive deep into the world of subscription billing solutions and explore why bu

What is a Payment Gateway and Why Your Business Needs One

Any business that accepts cashless transactions needs a payment gateway. A payment gateway is a tool that captures card information and securely transfers payment data from a customer to the acquirer, and then transfers the payment acceptance or decline back to the customer. If approved, the funds transfer to your business account. Why do you need a payment gateway? A payment gateway is necessary to validate a customer’s card details securely, ensuring funds are available for the purchase — s

Payment Acceptance for Businesses

In today's fast-paced and digital world, businesses need to stay ahead of the curve when it comes to accepting payments. Offering multiple payment options is no longer a luxury but a necessity for any successful business. Whether you're a brick-and-mortar store or an online retailer, understanding payment acceptance and setting up the right systems can make a significant difference in your bottom line. In this blog post, we will explore the importance of payment acceptance for businesses and wh