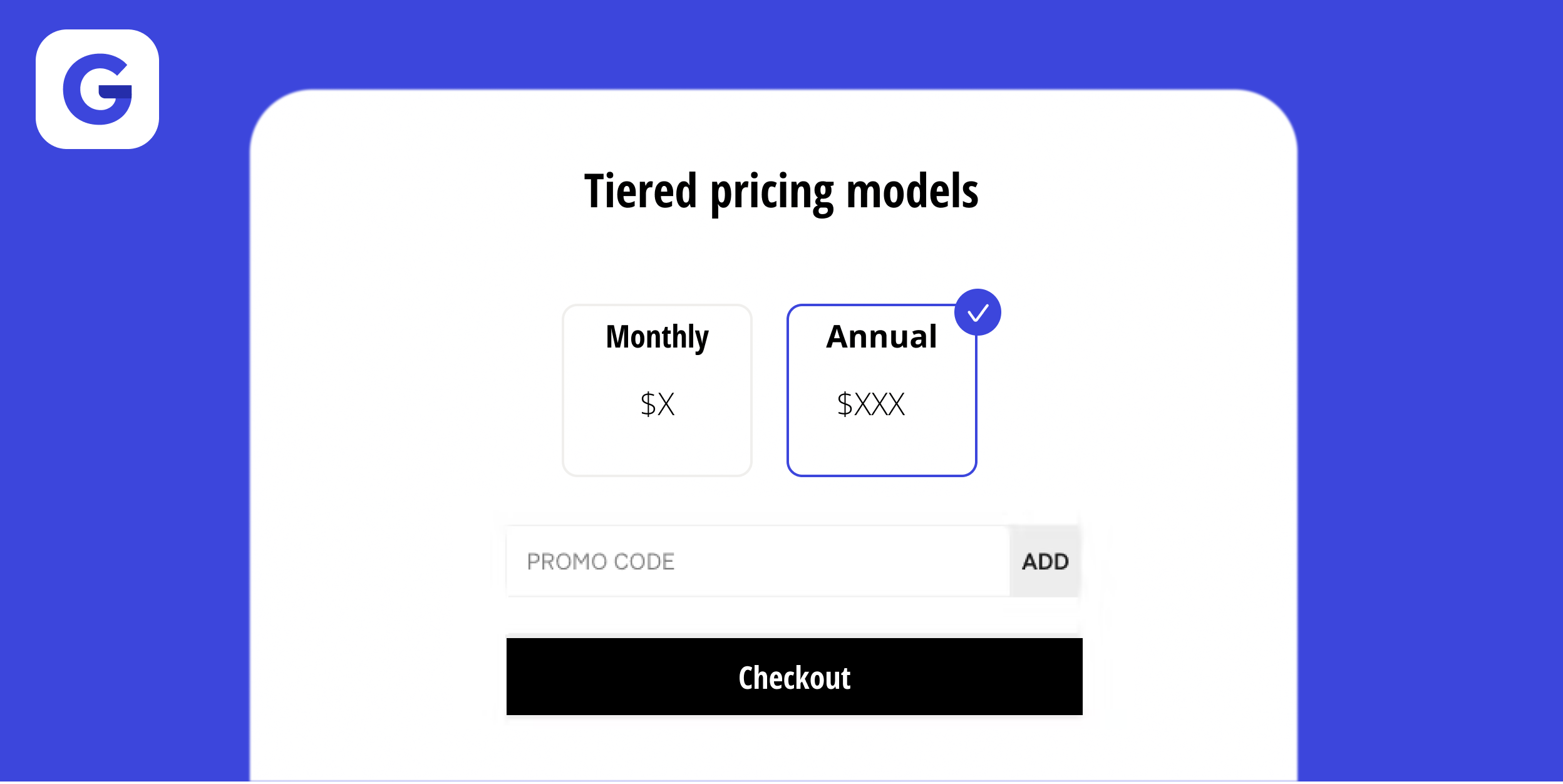

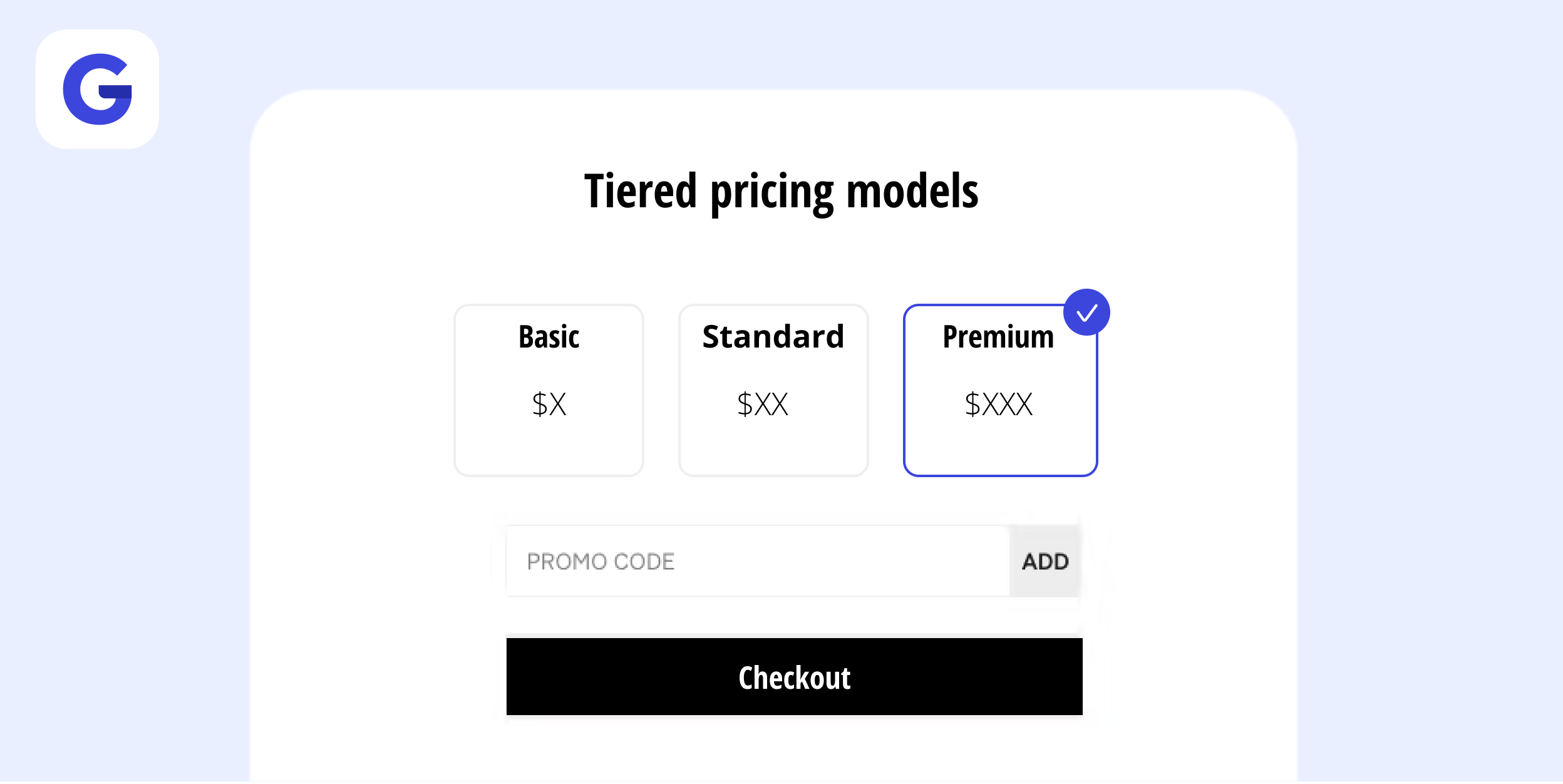

Understanding Subscription Billing Solutions

Subscription billing has become increasingly popular in recent years, with more and more businesses adopting this model to offer their products or services. From streaming platforms to software companies, subscription-based business models have proven to be successful and profitable. However, managing subscription billing can be complex and time-consuming without the right solution in place. In this blog post, we will dive deep into the world of subscription billing solutions and explore why bu

Why Businesses Need Recurring Billing Software in 2024

In today's fast-paced business environment, businesses are constantly looking for ways to optimize their processes and improve their bottom line. One area where efficiency can be greatly enhanced is in billing and payment management. Recurring billing software offers a powerful solution for businesses that have recurring revenue streams, such as subscription-based services or membership programs. With the ability to automate invoicing, manage subscriptions, and integrate with multiple payment g

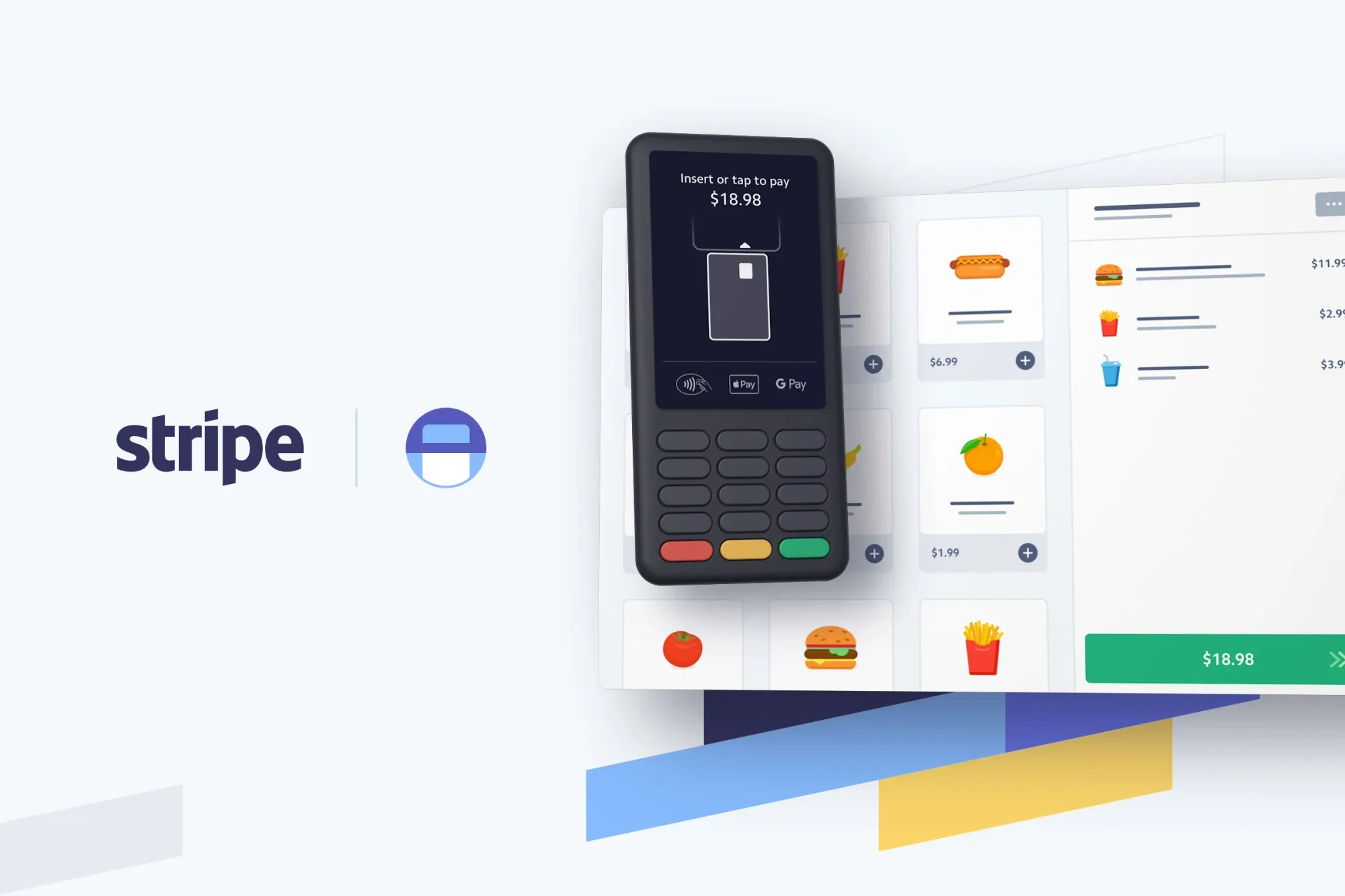

What is a Payment Gateway and Why Your Business Needs One

Any business that accepts cashless transactions needs a payment gateway. A payment gateway is a tool that captures card information and securely transfers payment data from a customer to the acquirer, and then transfers the payment acceptance or decline back to the customer. If approved, the funds transfer to your business account. Why do you need a payment gateway? A payment gateway is necessary to validate a customer’s card details securely, ensuring funds are available for the purchase — s

Payment Acceptance for Businesses

In today's fast-paced and digital world, businesses need to stay ahead of the curve when it comes to accepting payments. Offering multiple payment options is no longer a luxury but a necessity for any successful business. Whether you're a brick-and-mortar store or an online retailer, understanding payment acceptance and setting up the right systems can make a significant difference in your bottom line. In this blog post, we will explore the importance of payment acceptance for businesses and wh

What Is Payment Orchestration?

As the world becomes increasingly digital, the way we make payments is also evolving. Traditional payment processes are being replaced by more efficient and integrated solutions. One such solution is payment orchestration, a term that may be unfamiliar to many but is crucial for businesses operating in the digital realm. In this blog post, we will delve into the concept of payment orchestration, its importance, key components, implementation strategies, and future trends. Whether you are a busi

Payments for Retail: Revolutionizing the Way We Pay

In the ever-evolving world of retail, one critical aspect that continues to shape the industry is the way we make payments. Gone are the days of solely relying on cash transactions; today, we have entered an era where payments for retail have evolved to become faster, more secure, and more convenient than ever before. The Importance of Retail Payments Retail payments play a pivotal role in the success of any business. From small local stores to multinational retail giants, the ability to seam

Simplifying Business Payments: Alternative Payment Solutions for Small Businesses

In today's fast-paced business landscape, small businesses are constantly seeking ways to streamline their payment processes and offer convenient options to their customers. Alternative payment solutions have emerged as a valuable resource that goes beyond traditional cash and credit card transactions. In this article, we will explore alternative payments tailored specifically for small businesses, understanding their significance, benefits, and how to integrate them seamlessly. What are alter

Pay by Bank: How Businesses Can Save Money and Reduce Fraud

Open banking is a new technology that allows banks to share customer data with third-party companies. This data can be used to create new and innovative payment products, such as pay by bank. Pay by Bank is a method of payment that allows customers to make payments directly from their bank accounts. This is done by using the customer's online banking credentials to authorize a payment. There are a number of advantages to using Pay by Bank. Firstly, it is more secure than traditional payment me

The Complete Guide to Recurring Payments for Businesses

Recurring payments are a convenient and efficient way for businesses to collect payments from customers. They can also help businesses improve customer retention and build trust. In this blog post, we'll discuss what recurring payments are, how they work, and the benefits and drawbacks of using them. What are recurring payments? A recurring payment is a payment that is automatically processed on a regular basis. This could be weekly, monthly, quarterly, or even annually. Recurring payments ar

The Importance of Streamlined Business Payments: How to Improve Efficiency and Reduce Costs

As a business owner or manager, you know that cash flow is critical to the success of your company. One of the most significant factors that can impact cash flow is the efficiency of your payment processing systems. If your business payments are not streamlined, it can lead to delays, errors, and increased costs. In this blog post, we will explore the importance of streamlined business payments and provide some tips on how you can improve efficiency and reduce costs. Why Streamlined Business P

The Pros and Cons of Using Stripe Alternatives for Processing

When it comes to payment processing, Stripe has become the go-to choice for many businesses due to its ease of use, security, and scalability. However, there are also several alternatives to Stripe that businesses can choose from. In this blog post, we will explore the pros and cons of using Stripe alternatives for payment processing. Pros of Using Stripe Alternatives 1. Lower Fees One of the most significant advantages of using a Stripe alternative is the possibility of lower fees. Stripe's

The Benefits of Buy Now Pay Later: A Guide to Afterpay, Klarna, Affirm, and Zip

The rapid advancement of the digital age has brought about significant changes in consumer shopping habits. One such change is the emergence of Buy Now Pay Later (BNPL) services, revolutionizing the way people shop online. With the global BNPL market expected to reach $309.2 billion by 2023, this innovative payment method is projected to grow at a CAGR of 25.5% from 2023 to 2027. In this blog post, we will explore the concept of Buy Now Pay Later, delve into how it works, and highlight the benef

Navigating the Payments Landscape: What Businesses Need to Know

The payments landscape is constantly evolving, with new technologies and trends emerging all the time. This can make it difficult for businesses to keep up and choose the right payment solutions for their needs. Here are some things businesses need to know about the payments landscape: * The rise of digital payments - Digital payments are becoming increasingly popular, with consumers increasingly using their smartphones and other devices to make payments. This trend is being driven by factors

Why Digital Payments are Turning Green

The payments industry is under increasing pressure to go green. Consumers, businesses, and governments are all demanding more sustainable ways to make and receive payments. There are a number of reasons for this shift. First, the environmental impact of the payments industry is significant. The production, transportation, and use of cash and credit cards all contribute to greenhouse gas emissions. Second, the payments industry is ripe for innovation. There are a number of new technologies that

Why Businesses Should Switch to Contactless Payments

Contactless payments are becoming increasingly popular for Australian businesses. In fact, Australia is now the seventh most cashless country in the world. There are a number of reasons for this trend, including convenience, security, and the growing popularity of digital wallets, QR payments, and tap to pay. Convenience One of the biggest advantages of contactless payments is convenience. With contactless payments, you can simply tap your card or phone on a reader to pay for your purchase. Th