TrueLayer Introduces Payment Links: A New Way to Accept Instant Payments

TrueLayer, an open banking payment provider, today announced the launch of payment links, a new feature that enables businesses to offer instant payments, powered by open banking, directly from an email, text message or a QR code. Payment links are a simple and easy-to-use way for businesses to accept payments from customers. With payment links, businesses can create checkout pages within minutes, without the need for a website or third-party ecommerce platform integration. “Legacy payment opt

by Growpay

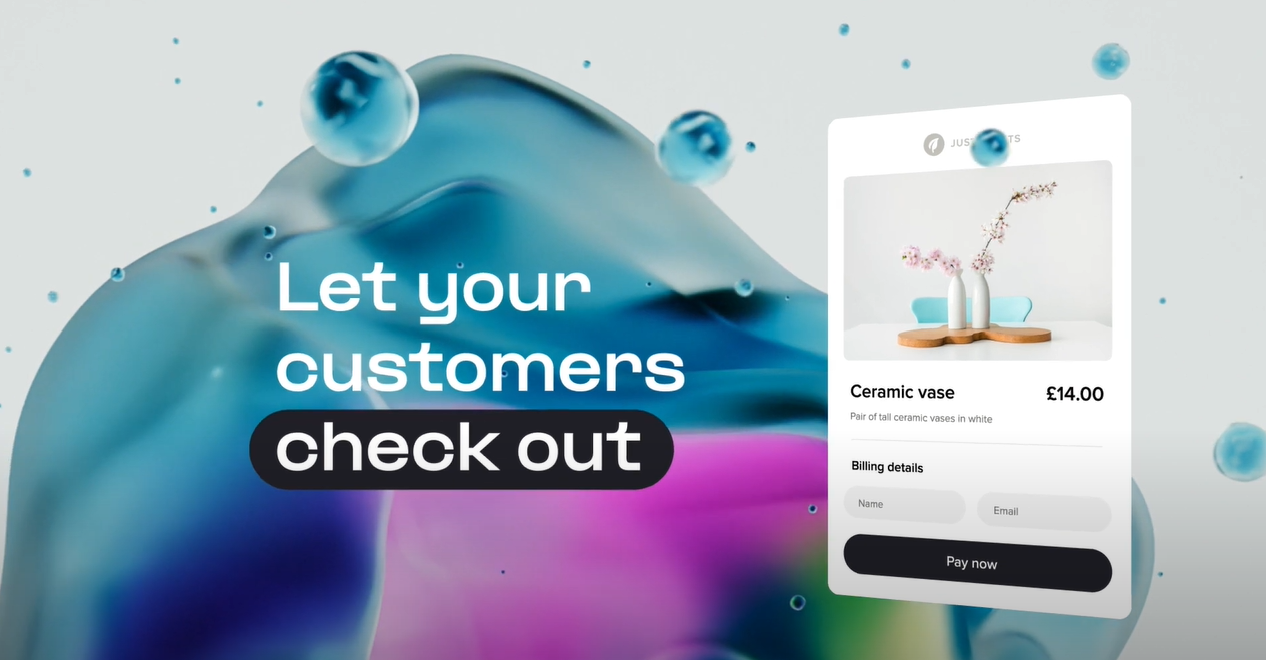

TrueLayer, an open banking payment provider, today announced the launch of payment links, a new feature that enables businesses to offer instant payments, powered by open banking, directly from an email, text message or a QR code.

Payment links are a simple and easy-to-use way for businesses to accept payments from customers. With payment links, businesses can create checkout pages within minutes, without the need for a website or third-party ecommerce platform integration.

“Legacy payment options such as cards simply haven’t kept up with the experiences customers and businesses have come to expect when making a purchase. These methods take days to settle, are highly frictional and often require a lot of resources to build payment infrastructure.

Powered by open banking, payment links are an easy-to-implement, instant-to-settle solution that will allow merchants to accept open banking payments anywhere: across their marketing channels, emails, texts and even in-store.

TrueLayer’s payment links are yet another proof point of how open banking can be used to transform business payments and consumer experiences. It once again demonstrates TrueLayer’s commitment to pushing what’s possible with open banking payments.” said Michael Brown, Head of Ecommerce at TrueLayer.

Payment links can be used for a variety of purposes, including;

- Invoicing - Businesses can use payment links to send invoice payment requests to customers. This can help to automate the invoicing process and reduce payment processing costs.

- Cart abandonment - Businesses can use payment links to target customers who have abandoned their carts. This can help to recover lost sales.

- Donations - Charities can use payment links to collect donations from supporters. This can help to make the donation process more convenient for supporters.

Businesses are using payment links to improve their invoicing processes and reduce payment processing costs. If you're looking for a simple and easy-to-use way to accept instant payments, then payment links are a great option.

Benefits of Using Payment Links

- Instant payments - Payments settle in real-time, so you get your money faster.

- Convenient for customers - Customers can pay from anywhere, using their preferred method.

- Easy to implement - No need to build a payment infrastructure or integrate with a third-party platform.

- Cost-effective - Payment links can help you save on payment processing fees.

How to Get Started with Payment Links

To get started with payment links, you'll need to sign up for a TrueLayer account. Once you have an account, you can create payment links in minutes.

To create a payment link, you'll need to provide some basic information, such as the amount of the payment and the customer's email address. You can also customize the payment link with your branding.

Once you've created a payment link, you can share it with your customers. They can then click on the link to pay you instantly.

Payment links are a powerful new tool that can help businesses accept instant payments from customers. If you're looking for a simple and easy-to-use way to improve your payment processing, then payment links are a great option.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them