Worldpay and Affirm Team Up to Offer Buy Now, Pay Later

Worldpay, a global payments technology company, has partnered with Affirm, a buy now, pay later (BNPL) provider, to offer consumers a new way to pay for their purchases. Through the partnership, eligible Worldpay merchants will be able to offer Affirm's Adaptive Checkout solution, which allows customers to split their purchases into bi-weekly or monthly payments with no interest or late fees. "It's becoming increasingly important for merchants to provide pay-over-time payment solutions with con

by Growpay

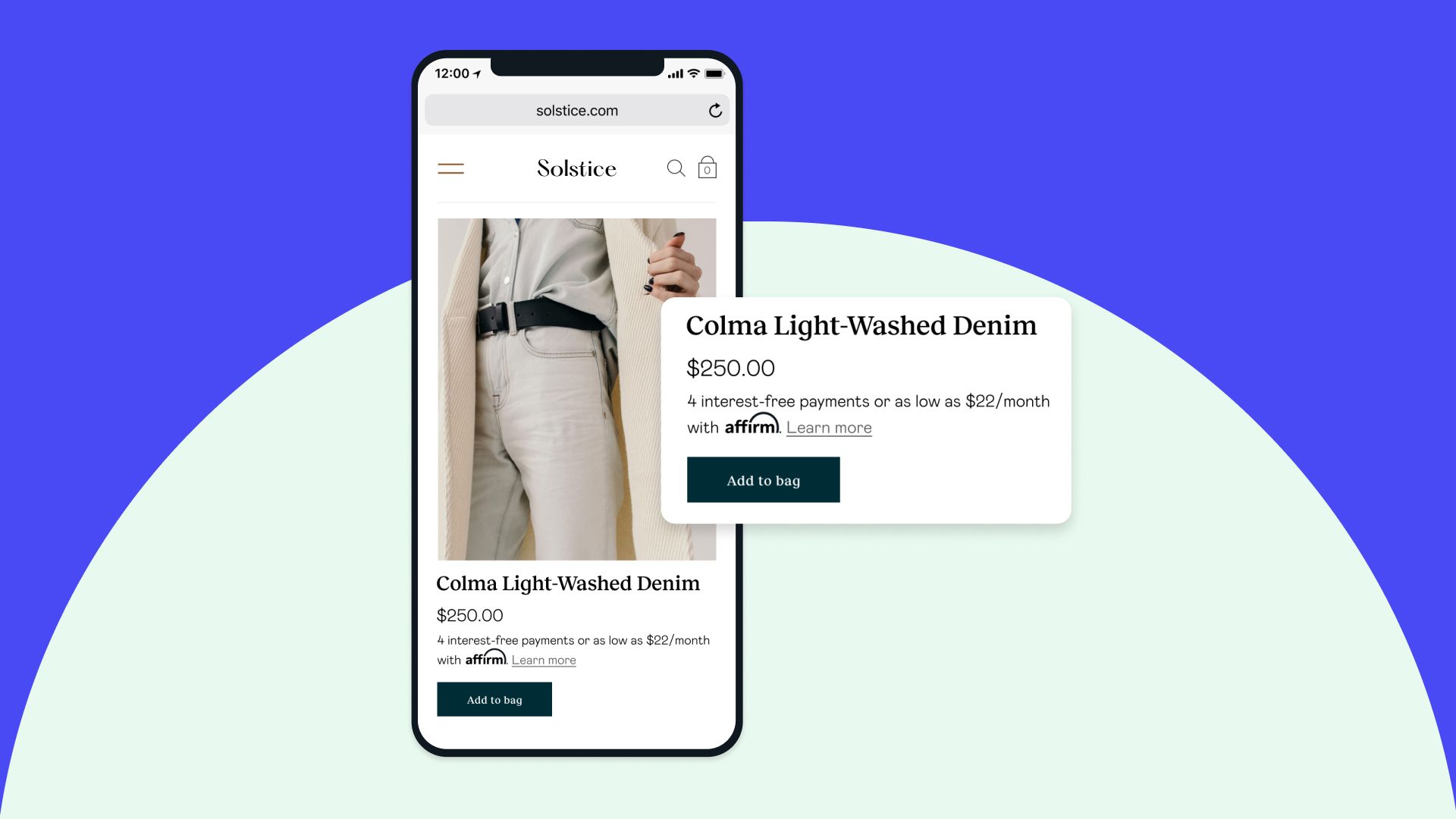

Worldpay, a global payments technology company, has partnered with Affirm, a buy now, pay later (BNPL) provider, to offer consumers a new way to pay for their purchases. Through the partnership, eligible Worldpay merchants will be able to offer Affirm's Adaptive Checkout solution, which allows customers to split their purchases into bi-weekly or monthly payments with no interest or late fees.

"It's becoming increasingly important for merchants to provide pay-over-time payment solutions with consumer demand continuing to grow," said Jim Johnson, head of merchant solutions at Worldpay parent company FIS. "By integrating Affirm's products at checkout our merchants will be best placed to capture new sales opportunities and revenue streams, helping them continue to grow into the future."

Affirm's BNPL solution is popular with consumers because it offers a more flexible and transparent way to pay for purchases. Customers who use Affirm go through a quick soft credit check during checkout, which doesn't affect their credit score. Once approved, they can split their purchases into bi-weekly or monthly payments with no interest or late fees.

"Consumers are demanding more flexible and transparent options that enable them to pay over time without any junk fees or hidden charges," said Becca Stone, vice president of strategic partnerships at Affirm. "By partnering with Worldpay, we are excited to expand the reach of our honest financial products."

The partnership between Worldpay and Affirm comes as Buy Now Pay Later continues to grow in popularity. In a recent earnings report, Affirm reported that its gross sales volume grew by 18% year over year. The company also said that travel remains a key area of strength for BNPL, with volume growth of 62% in that category.

The partnership between Worldpay and Affirm is a sign of the growing popularity of BNPL. As more and more consumers look for flexible and transparent ways to pay for their purchases, BNPL is likely to continue to grow in popularity for consumers and businesses.

Here are some of the benefits of Buy Now Pay Later (BNPL) for businesses:

- Increased sales - BNPL can help merchants increase sales by making it easier for customers to afford their purchases. A study by Affirm found that merchants who offer BNPL saw a 30% increase in average order value and a 10% increase in conversion rate.

- Improved customer satisfaction - BNPL can help improve customer satisfaction by giving customers more flexibility and control over their spending. A study by PayPal found that 80% of BNPL users said they were more likely to shop with a merchant that offers BNPL.

- New customer acquisition - BNPL can help merchants acquire new customers by reaching a wider audience. A study by Klarna found that 40% of BNPL users were new to the merchant they were shopping with.

- Reduced cart abandonment - BNPL can help reduce cart abandonment by giving customers a way to pay for their purchases even if they don't have the full amount available. A study by Afterpay found that BNPL reduced cart abandonment by 40%.

Buy Now Pay Later can be a valuable tool for businesses who are looking to increase sales, improve customer satisfaction, acquire new customers, and reduce cart abandonment.

In addition to the benefits mentioned above, BNPL can also help businesses:

- Improve their cash flow - BNPL providers typically pay merchants in full upfront, which can help improve a merchant's cash flow.

- Reduce the risk of chargebacks - BNPL providers typically have strict underwriting criteria, which can help reduce the risk of chargebacks.

- Increase brand awareness - BNPL providers often promote their merchants' brands, which can help drive awareness and traffic to your website or trips in-store.

If you're a business, you should consider offering BNPL to your customers. It's a growing payment method that can offer a wide range of benefits to your business and customers.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them