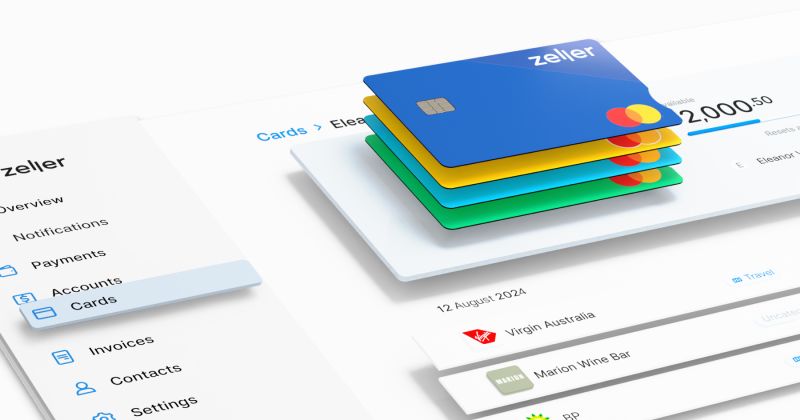

Zeller Launches Corporate Cards for Businesses.

In the dynamic world of business, efficient expense management is crucial for maintaining financial stability and growth. Zeller, a leading Australian FinTech, has introduced Zeller Corporate Cards, a revolutionary solution that addresses the prevailing pain points in existing expense management offerings and caters to the evolving needs of Australian businesses. A Versatile Payment Solution for Diverse Business Needs Zeller Corporate Cards offer versatility in application, extending beyond i

by Growpay

In the dynamic world of business, efficient expense management is crucial for maintaining financial stability and growth. Zeller, a leading Australian FinTech, has introduced Zeller Corporate Cards, a revolutionary solution that addresses the prevailing pain points in existing expense management offerings and caters to the evolving needs of Australian businesses.

A Versatile Payment Solution for Diverse Business Needs

Zeller Corporate Cards offer versatility in application, extending beyond individual use for day-to-day expenses to encompass a range of scenarios:

- Standalone projects - Consolidate expenditure for specific projects and track progress effectively.

- Departmental or team expenses - Empower teams to manage their expenses while maintaining overall financial control.

- Client cards - Issue cards to clients for streamlined payments and expense tracking.

- Multi-location expense management - Track and manage expenses across different business locations seamlessly.

Tailored to Empower Businesses of All Sizes

Zeller Corporate Cards cater to a broad spectrum of businesses, from small startups to large enterprises, addressing the needs of business owners, CFOs, accountants, and bookkeepers alike.

Features That Enhance Expense Management

Zeller Corporate Cards are packed with powerful features that streamline expense management:

- Instant card creation - Issue virtual cards instantly or order physical cards for flexibility.

- Budget controls - Automate recurring budgets and set transaction limits to ensure spending stays within defined parameters.

- Streamlined reconciliation - Attach notes, receipts, and invoices directly to expenses for paperless record-keeping and efficient reconciliation.

- Project and team-level management - Manage budgets at a project or team level for granular control over expenditure.

- Real-time visibility - Finance teams can track expenses and cash balance in real-time through the intuitive Zeller Dashboard.

A Unified Financial Management System

Zeller Corporate Cards seamlessly integrate with EFTPOS payments, online invoicing, transaction accounts, debit cards, and more, providing a unified financial management system. This centralized platform offers businesses a real-time view of every financial interaction, optimizing expense tracking and management efficiency.

Embrace the Future of Expense Management

Zeller Corporate Cards represent a significant leap forward in business expense management, offering businesses of all sizes a comprehensive and versatile solution to streamline expenditure, enhance control, and gain real-time financial insights. Empower your business with Zeller Corporate Cards and experience the future of expense management today.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them