Zip partners with Primer to accelerate growth in the US

Zip, a leading global buy now, pay later (BNPL) payment provider, and Primer, a payment orchestration platform have announced a partnership to accelerate BNPL growth in the U.S. The partnership will see Primer provide Zip with access to its payments infrastructure, including card acquirers and processors, fraud and communication tools, and fallback features. This will help Zip to reduce its operational costs and scale its BNPL offering in the U.S. In addition, Primer will also add Zip as a pay

by Growpay

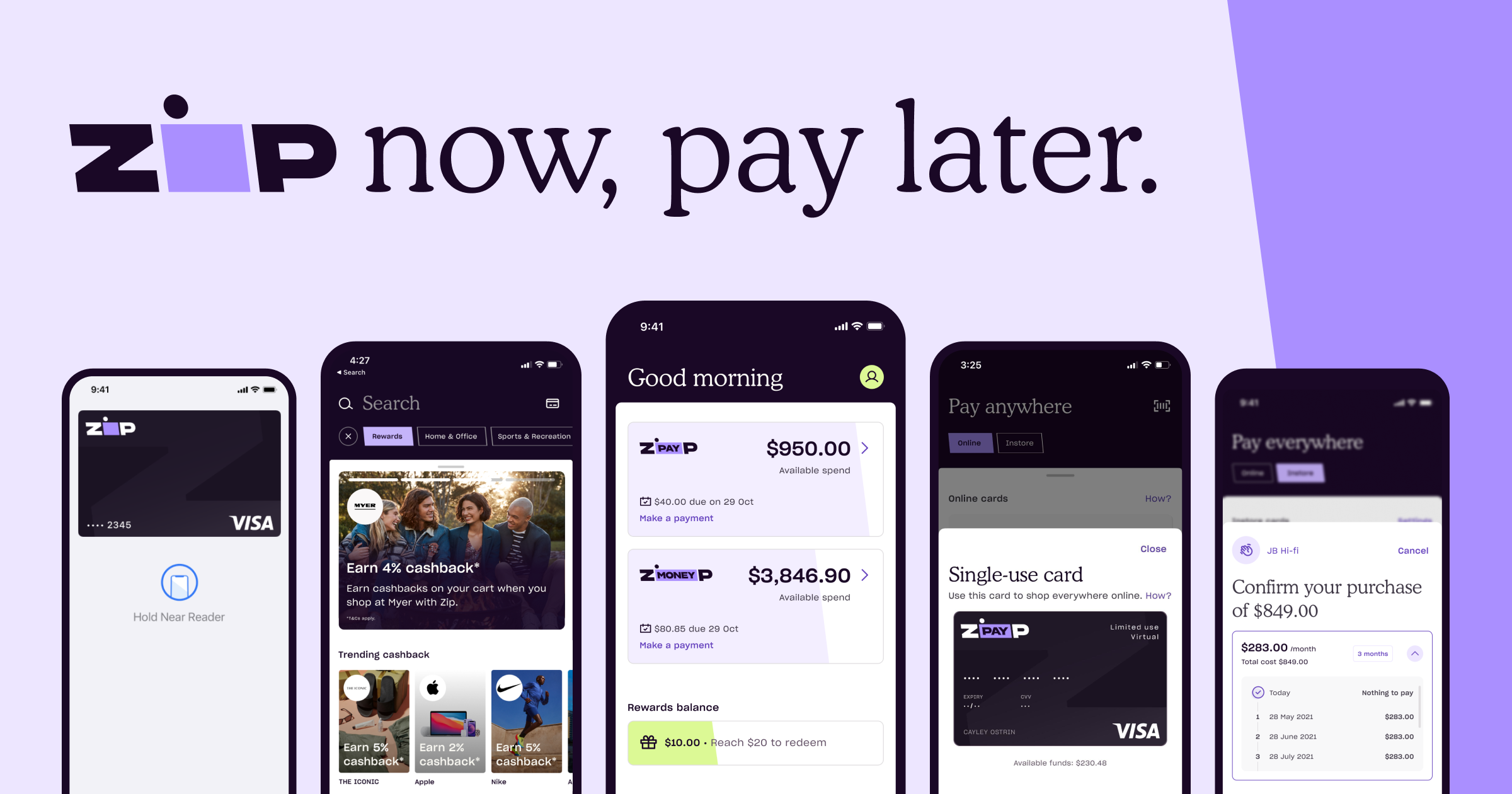

Zip, a leading global buy now, pay later (BNPL) payment provider, and Primer, a payment orchestration platform have announced a partnership to accelerate BNPL growth in the U.S.

The partnership will see Primer provide Zip with access to its payments infrastructure, including card acquirers and processors, fraud and communication tools, and fallback features. This will help Zip to reduce its operational costs and scale its BNPL offering in the U.S.

In addition, Primer will also add Zip as a payment option, allowing merchants to offer BNPL to their customers. This will make it easier for consumers to use BNPL at a wider range of stores and online retailers.

“With an $11 trillion total addressable market in the U.S., BNPL services account for a mere 2% of all payments,” said Larry Diamond, Co-founder and U.S. CEO of Zip. “Our partnership with Primer not only accelerates Zip’s growth trajectory but also positions us to seize this colossal market opportunity in a scalable and sustainable manner.”

“We're thrilled to be the infrastructure of choice for Zip,” said Gabriel Le Roux, Co-founder of Primer. “While delivering localized payments expertise, optimization features and insights, we’re supporting leading companies like Zip to optimize payment costs and capture untapped revenue opportunities.”

Benefits of the Partnership

The partnership between Zip and Primer will provide a number of benefits for both companies, including:

- Increased access to merchants - Primer’s payments infrastructure will give Zip access to a wider range of merchants, which will help to grow its BNPL business.

- Reduced operational costs - Primer’s fraud and communication tools will help Zip to reduce its operational costs, freeing up resources to focus on growth.

- Increased visibility - Primer’s insights will give Zip greater visibility into its payments data, which will help it to make better decisions about its business.

- Enhanced customer experience - By offering Zip as a payment option, Primer will make it easier for consumers to use BNPL at a wider range of stores and online retailers.

The partnership between Zip and Primer is a significant development for the Buy Now Pay Later market in the U.S. It is expected to help to drive adoption of BNPL among consumers and merchants, and to contribute to the growth of the BNPL market in the years to come.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

Bolt & Checkout.com Partner to Advance Ecommerce and Payments.

Great news for online businesses! Leading checkout technology company Bolt and global payment solutions provider Checkout.com have joined forces to simplify the online shopping experience and boost your sales. "By integrating Bolt's industry-leading checkout technology with Checkout.com's enterprise-grade payment solutions, we are helping merchants deliver a better shopper experience and higher conversion by leveraging Bolt's fast-growing shopper network," said Bolt CEO Maju Kuruvilla. "This pa

NAB Partners with Thriday to Offer AI-powered Bookkeeping

Great news for Australian small businesses! NAB has partnered with innovative fintech company Thriday to offer NAB Bookkeeper, a revolutionary tool that leverages AI to streamline your finances and free up your valuable time. Why AI for Bookkeeping? The numbers speak for themselves: * 20% of Aussie small businesses are planning to invest in AI tools, while 23% have already taken the plunge. * Businesses see AI as a game-changer, expecting it to cut admin time in half and boost profitabilit

Douugh Pay: Attract More Loyal Customers at Checkout.

Douugh has announced the launch of Douugh Pay, a new way for businesses to attract more loyalty and customers at checkout. As a merchant, you now have the opportunity to offer a unique and valuable rewards program that sets you apart from the competition: Stockback™ - A simple way for your customers earn stocks at checkout. “We are delighted to finally announce the full market launch of Douugh Pay with our first merchant partner... We strongly believe that partnering with merchants to help them