The Benefits of Buy Now Pay Later: A Guide to Afterpay, Klarna, Affirm, and Zip

The rapid advancement of the digital age has brought about significant changes in consumer shopping habits. One such change is the emergence of Buy Now Pay Later (BNPL) services, revolutionizing the way people shop online. With the global BNPL market expected to reach $309.2 billion by 2023, this innovative payment method is projected to grow at a CAGR of 25.5% from 2023 to 2027. In this blog post, we will explore the concept of Buy Now Pay Later, delve into how it works, and highlight the benef

by Growpay

The rapid advancement of the digital age has brought about significant changes in consumer shopping habits. One such change is the emergence of Buy Now Pay Later (BNPL) services, revolutionizing the way people shop online. With the global BNPL market expected to reach $309.2 billion by 2023, this innovative payment method is projected to grow at a CAGR of 25.5% from 2023 to 2027. In this blog post, we will explore the concept of Buy Now Pay Later, delve into how it works, and highlight the benefits it provides for businesses, with a focus on popular platforms like Afterpay, Klarna, Affirm, and Zip.

Understanding Buy Now Pay Later

Buy Now Pay Later is a payment option that enables customers to make purchases and defer the full payment. Instead of paying the entire amount upfront, customers can split the cost into equal installments over a specified period, typically ranging from a few weeks to several months. In most cases, these installments are interest-free, making BNPL an appealing and affordable alternative to traditional credit options.

How Does Buy Now Pay Later Work?

Checkout Process - When a customer chooses to use a BNPL service at the checkout, they select the relevant payment option provided by the retailer. They are then redirected to the BNPL service's platform to create an account or log in if they already have one.

Approval Process - The BNPL service assesses the customer's creditworthiness by conducting a quick credit check or evaluating their transaction history. Unlike traditional credit options, the approval process is usually faster, with many BNPL providers approving transactions within minutes.

Split Payments - Once the purchase is approved, the customer can complete the transaction and make their initial payment, which is typically a fraction of the total purchase amount. The remaining balance is divided into equal installments, which are automatically deducted from the customer's chosen payment method at regular intervals (e.g., weekly or bi-weekly) until the full amount is paid off.

Benefits of Buy Now Pay Later for Businesses

Increased Conversion Rates - By offering a BNPL option, businesses can eliminate a significant barrier to purchase, especially for customers who may not have sufficient funds to pay upfront or are hesitant to use credit cards. This can result in higher conversion rates, as customers are more likely to complete the purchase when they have the flexibility to pay in installments.

Higher Average Order Value - BNPL services often enable customers to afford higher-priced items by spreading the cost over time. This can lead to an increase in the average order value for businesses, as customers are more inclined to make larger purchases when they have the option to pay in installments.

Attracting New Customers - BNPL services have gained popularity among millennials and Gen Z, who value financial flexibility and prefer alternative payment options. By offering BNPL, businesses can attract new customers who may not have otherwise considered making a purchase.

Enhanced Customer Loyalty - Providing customers with the convenience and flexibility of BNPL can foster loyalty and encourage repeat business. When customers have positive experiences with a business's payment options, they are more likely to return for future purchases.

Integration and Marketing Support - BNPL providers often offer seamless integration with popular e-commerce platforms, making it easier for businesses to implement this payment method. Additionally, some BNPL services provide marketing support, including targeted promotions and advertising, which can help drive sales and increase customer engagement.

Simplifying Payments with Buy Now Pay Later

Afterpay

Afterpay is one of the most popular BNPL services known for its simplicity and user-friendly approach.

With Afterpay, customers can split their payments into four equal installments paid over a six-week period. Afterpay charges no interest or fees if customers pay on time. It integrates seamlessly with various e-commerce platforms and allows businesses to provide a frictionless checkout experience. Afterpay has a large user base, particularly among younger demographics, making it an ideal choice for businesses targeting millennials and Gen Z.

Klarna

Klarna is another prominent player in the BNPL space, offering a range of payment options to customers. Apart from splitting payments into installments, Klarna allows users to pay later, providing flexibility in managing their finances. Klarna's user-friendly app and smooth checkout experience contribute to its popularity. Klarna also offers businesses various marketing tools, such as targeted promotions and personalized offers, to drive sales and enhance customer engagement. If your business focuses on creating a personalized shopping experience and reaching a broad customer base, Klarna might be a suitable choice.

Affirm

Affirm differentiates itself by offering installment plans with transparent interest rates, allowing customers to make informed decisions. Unlike some other BNPL services, Affirm charges interest on its installment plans, but customers can see the interest rate upfront. This transparency can help build trust with customers and provide them with a clear understanding of their financial commitments. Affirm also offers higher-value financing options, making it suitable for businesses selling expensive products or targeting a market with a higher average order value.

Zip

Originally established in Australia, Zip has gained popularity in recent years, expanding its services internationally. Zip offers both BNPL options and longer-term interest-bearing loans, providing customers with flexibility. Businesses that partner with Zip can benefit from its marketing support, including targeted promotions and access to Zip's extensive user base. If your business operates in multiple countries and wants to leverage the global presence of Zip, it can be an excellent choice.

Choosing the Right BNPL for Your Business

When deciding which BNPL service is right for your business, consider factors such as your target audience, integration capabilities with your e-commerce platform, fees and interest rates, marketing and promotional tools, international presence, customer experience, and the reputation of the BNPL service provider. By evaluating these factors, you can make an informed decision that aligns with your business goals and enhances the overall shopping experience for your customers. Payments discovery platforms such as Growpay, can be a great resource for businesses when assessing payment options, whether it be processors, wallets, buy now pay later, expense platforms, payroll software or others.

The rise of Buy Now Pay Later services, including popular platforms like Afterpay, Klarna, Affirm, and Zip, has revolutionized online shopping. These services offer customers the flexibility to pay in installments and provide businesses with opportunities to boost sales and attract new customers. By understanding the concept of BNPL, evaluating the available service providers, and considering various factors, businesses can make informed decisions in selecting the right BNPL service that aligns with their goals and enhances the overall shopping experience for their customers.

About Growpay

Growpay is an online marketplace, helping simplify payment discovery for businesses worldwide. For more information, visit www.growpay.co.

Relevant Articles

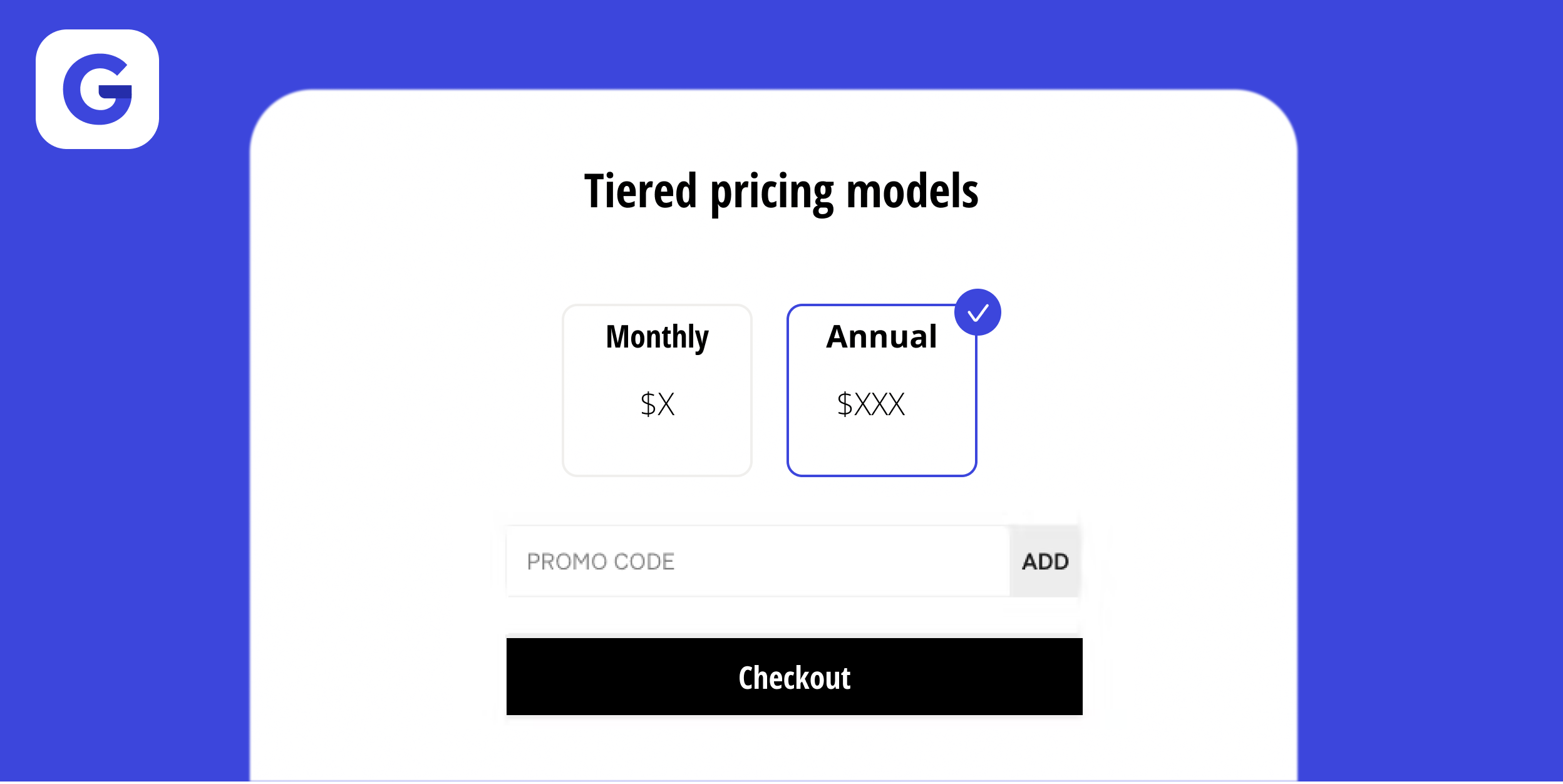

Understanding Subscription Billing Solutions

Subscription billing has become increasingly popular in recent years, with more and more businesses adopting this model to offer their products or services. From streaming platforms to software companies, subscription-based business models have proven to be successful and profitable. However, managing subscription billing can be complex and time-consuming without the right solution in place. In this blog post, we will dive deep into the world of subscription billing solutions and explore why bu

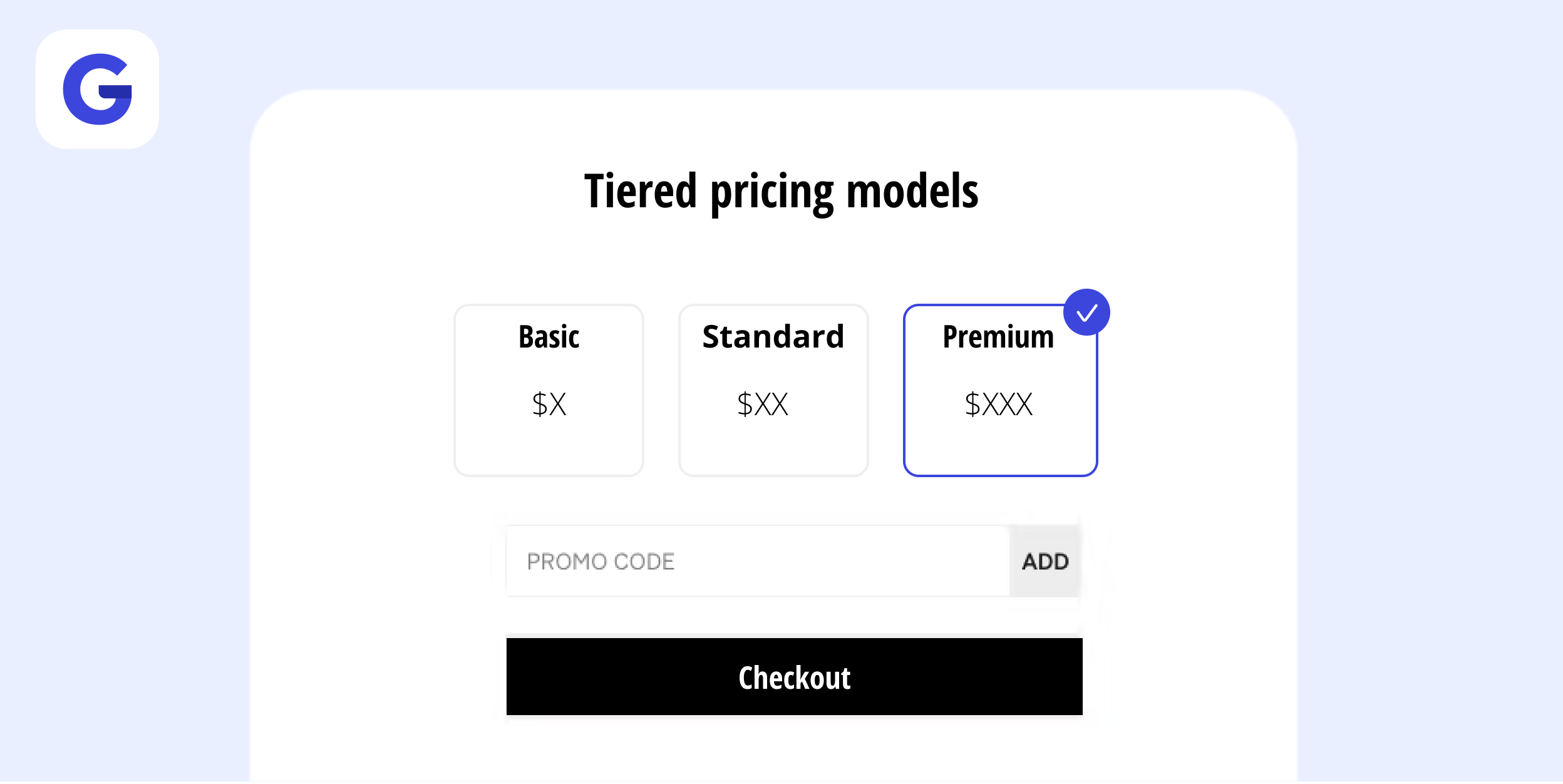

Why Businesses Need Recurring Billing Software in 2024

In today's fast-paced business environment, businesses are constantly looking for ways to optimize their processes and improve their bottom line. One area where efficiency can be greatly enhanced is in billing and payment management. Recurring billing software offers a powerful solution for businesses that have recurring revenue streams, such as subscription-based services or membership programs. With the ability to automate invoicing, manage subscriptions, and integrate with multiple payment g

What is a Payment Gateway and Why Your Business Needs One

Any business that accepts cashless transactions needs a payment gateway. A payment gateway is a tool that captures card information and securely transfers payment data from a customer to the acquirer, and then transfers the payment acceptance or decline back to the customer. If approved, the funds transfer to your business account. Why do you need a payment gateway? A payment gateway is necessary to validate a customer’s card details securely, ensuring funds are available for the purchase — s