The Latest from Growpay

Growpays outlook on the future of payments.

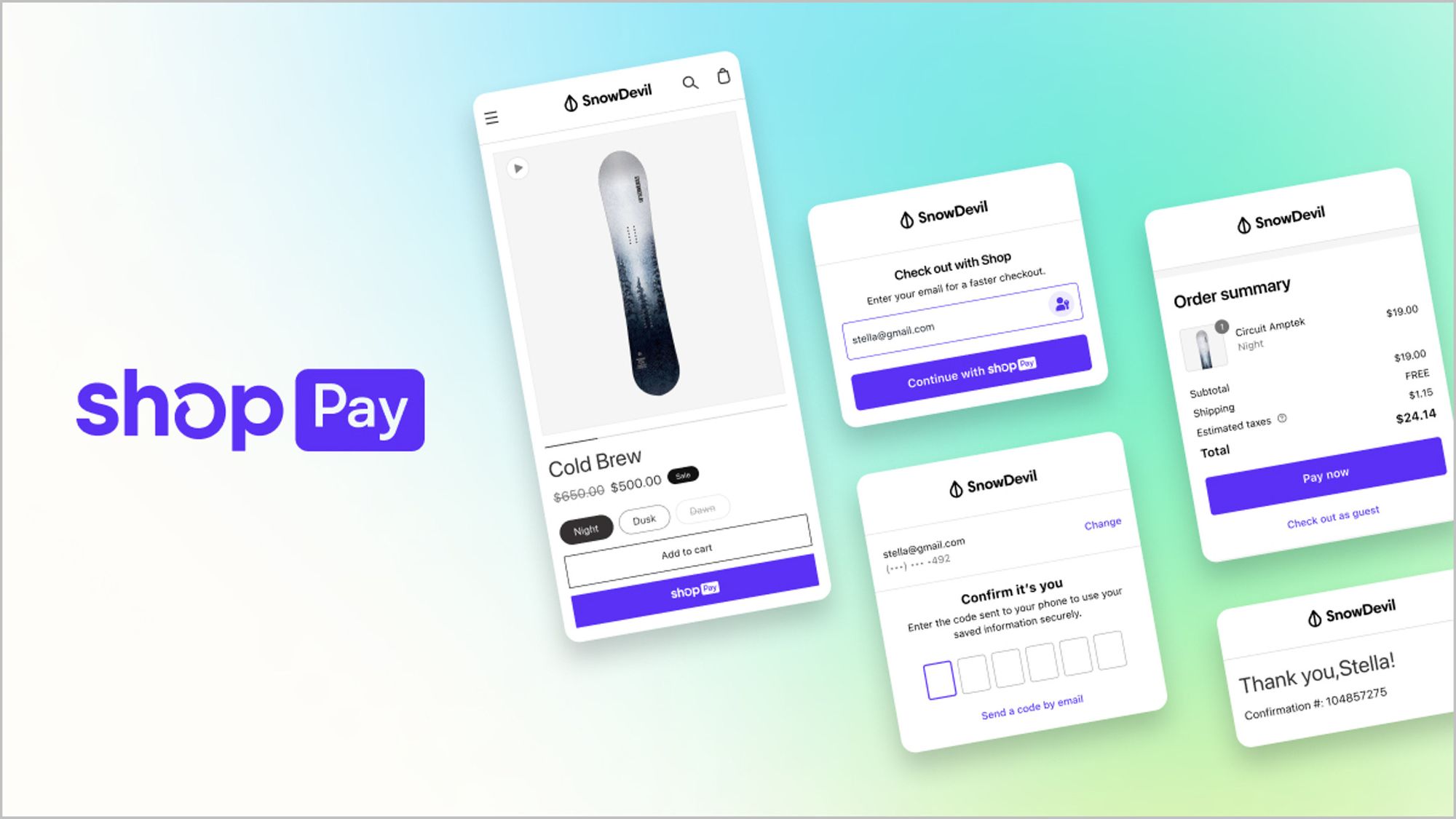

Shop Pay is now available to enterprise retailers not on Shopify

Shopify is making its highest-converting accelerated checkout, Shop Pay, available to enterprise retailers not on Shopify. This is made possible through Commerce Components by Shopify (CCS), which gives enterprise retailers access to the same Shopify components that power 10% of U.S. commerce. Shop Pay is a one-click checkout that uses Shopify's massive identity network to recognize customers and pre-fill their information. This makes the checkout process up to 4x faster than a guest checkout.

Adyen and Shopify Partner to Help Enterprise Merchants Grow

Adyen, the global payments platform, and Shopify, the leading provider of essential internet infrastructure for commerce, have announced a new partnership to provide enterprise merchants with a more flexible and integrated payments experience. The partnership will allow Shopify merchants to use Adyen's global payment network, which includes support for over 550 payment methods in over 200 countries and regions. This will give merchants the ability to accept payments from customers around the wo

Square for Restaurants: The Payments Platform for Managing Multiple Restaurant Locations

Square for Restaurants, Square's suite of offerings for restaurants and food and beverage businesses, has seen significant growth upmarket over the last year. The company has launched new products to help restaurants of all sizes manage their operations more efficiently and grow their businesses. One of the new products is Square KDS (kitchen display system), which integrates directly with Square Restaurant POS. This allows kitchen staff to see incoming tickets on large, durable, and configurab

PayPal and MYOB Integrate to Offer BNPL and Faster Payments for SMEs

PayPal and MYOB have announced a new integration that will allow MYOB customers to accept payments via PayPal and PayPal Pay in 4. This is the first time that a Buy Now Pay Later (BNPL) service has been available within MYOB. The integration is expected to help businesses get paid faster and more securely, improving cashflow and reducing the burden of chasing and waiting for payments. For MYOB customers who have online invoice payments enabled, invoices will feature buttons for PayPal and PayP

How Businesses Can Benefit from the American Express and Envestnet | Yodlee Partnership

American Express and Envestnet | Yodlee have announced a new partnership that will offer American Express customers new digital banking options. The partnership will allow American Express customers to connect their accounts to thousands of third-party financial apps and services without having to share their account credentials. The partnership will use Envestnet | Yodlee's data aggregation and analytics platform to provide American Express customers with a secure and seamless way to connect t

Navigating the Payments Landscape: What Businesses Need to Know

The payments landscape is constantly evolving, with new technologies and trends emerging all the time. This can make it difficult for businesses to keep up and choose the right payment solutions for their needs. Here are some things businesses need to know about the payments landscape: * The rise of digital payments - Digital payments are becoming increasingly popular, with consumers increasingly using their smartphones and other devices to make payments. This trend is being driven by factors

Why Digital Payments are Turning Green

The payments industry is under increasing pressure to go green. Consumers, businesses, and governments are all demanding more sustainable ways to make and receive payments. There are a number of reasons for this shift. First, the environmental impact of the payments industry is significant. The production, transportation, and use of cash and credit cards all contribute to greenhouse gas emissions. Second, the payments industry is ripe for innovation. There are a number of new technologies that

Amazon Pay Extends Buy Now Pay Later Partnership with Affirm in the US

Affirm, a buy now, pay later (BNPL) company, has expanded its partnership with Amazon Pay. As part of the new agreement, any Amazon Pay merchant in the U.S. can now offer Affirm as a payment option to their customers. Affirm's BNPL service allows customers to split the cost of a purchase into four equal payments, made every two weeks. There are no late fees or interest charges, as long as the payments are made on time. “We know customers want convenient and flexible payment options—whether the

Worldpay and Volt Partner to Bring Open Banking to Merchants Worldwide

Worldpay has partnered with Volt to provide merchants with account to account based payments. In a recent announcement, the two companies revealed that they are teaming up to bring open banking to merchants around the world. This partnership will give merchants access to a wide range of open banking features, including: * Account-to-account (A2A) payments: A2A payments allow customers to make payments directly from their bank accounts to a merchant's account. This is a fast, secure, and conven