The Latest from Growpay

Growpays outlook on the future of payments.

Why Businesses Should Switch to Contactless Payments

Contactless payments are becoming increasingly popular for Australian businesses. In fact, Australia is now the seventh most cashless country in the world. There are a number of reasons for this trend, including convenience, security, and the growing popularity of digital wallets, QR payments, and tap to pay. Convenience One of the biggest advantages of contactless payments is convenience. With contactless payments, you can simply tap your card or phone on a reader to pay for your purchase. Th

How Supporting New Payment Methods Can Grow Your Business

The world of payments is changing rapidly. New payment methods are emerging all the time, and consumers are increasingly demanding more choice and convenience when it comes to how they pay for goods and services. For businesses, this presents both an opportunity and a challenge. On the one hand, supporting new payment methods can help to attract new customers and boost sales. On the other hand, it can be costly and complex to implement new payment solutions. Here are a few tips for businesses

Adyen Launches Payout Services to Improve Cash Flow for Businesses

Adyen, the global payments platform announced this week the launch of Payout Services, a new offering that enables businesses to payout acquired funds to their users or partners in the preferred method with increased velocity. With Payout Services, businesses can: * Payout funds to their users or partners in real time or within 24 hours, regardless of their location. * Choose from a variety of payout methods, including bank transfers, wallets, and gift cards. * Manage payouts globally with a s

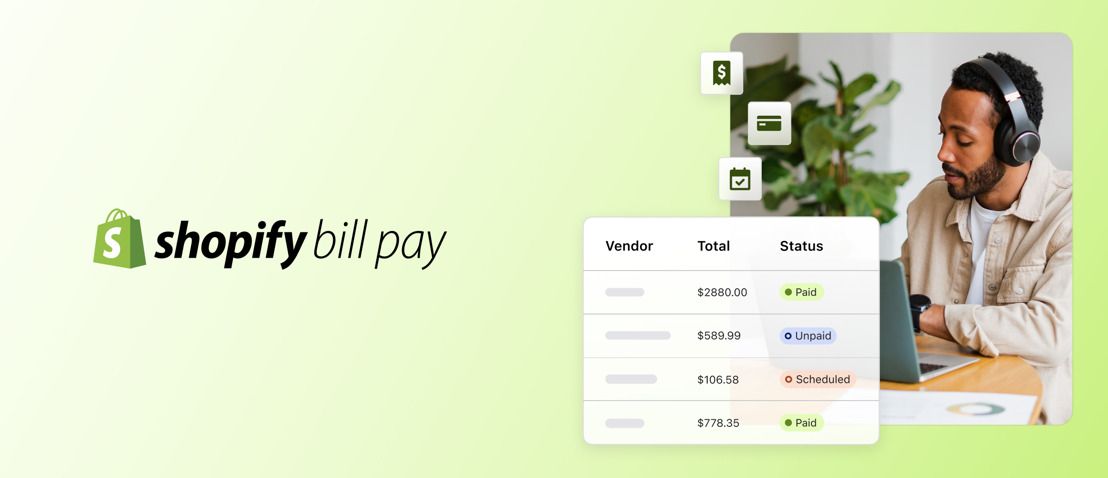

Shopify Bill Pay: A New Tool to Streamline Expense Management

Do you spend hours every month tracking down invoices, entering data, and making payments? If so, you're not alone. Managing expenses is a time-consuming task that can take away from running your business. It was announced last week that Shopify Bill Pay will save merchants up to 16 hours per month on paying business expenses, and is 2x faster than other businesses expenses management solutions. Through Shopify Bill Pay, Shopify continues to build a suite of embedded financial solutions that

How Stripe's Charge Card Program Can Help You Grow Your Business

Stripe, a financial infrastructure platform for businesses, announced yesterday a new charge card program for Stripe Issuing, Stripe’s commercial card issuing product. With the addition of charge cards, fintechs and platforms can create and distribute virtual or physical charge cards that allow their customers to spend on credit rather than the funds in their accounts—providing new revenue streams for platforms and allowing them to offer new financing capabilities to their customers. “Whether a

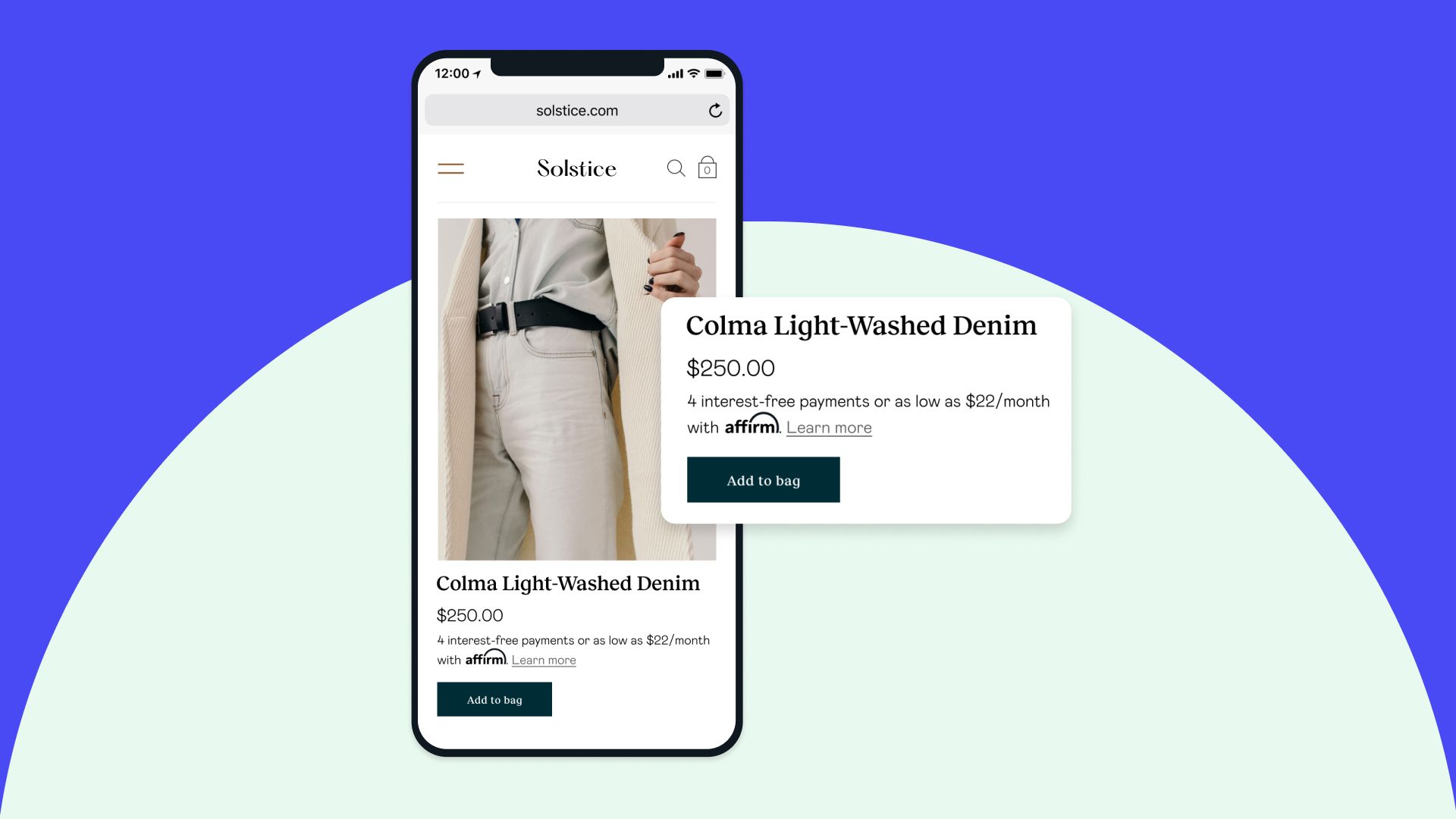

Worldpay and Affirm Team Up to Offer Buy Now, Pay Later

Worldpay, a global payments technology company, has partnered with Affirm, a buy now, pay later (BNPL) provider, to offer consumers a new way to pay for their purchases. Through the partnership, eligible Worldpay merchants will be able to offer Affirm's Adaptive Checkout solution, which allows customers to split their purchases into bi-weekly or monthly payments with no interest or late fees. "It's becoming increasingly important for merchants to provide pay-over-time payment solutions with con

Understanding Least Cost Routing and its Benefits for Your Business

Reducing costs and maintaining profitability is a top priority for businesses globally. In Australia, one effective way to achieve this is through Least Cost Routing (LCR), an opt-in feature on merchant facilities. LCR allows you to choose the payment network that results in the lowest cost for your business, specifically for tap-and-go dual-network debit card transactions. In this blog post, we will delve into the details of Least Cost Routing, how it works, and the benefits it can offer to you

Airwallex and TrueLayer Partner to Deliver Innovative Payment Solutions for Businesses

Airwallex, the leading global payments and financial platform for modern businesses, announced last week a partnership with TrueLayer, the payments network powered by open banking. The partnership will enable businesses to access a wider range of payment options, including real-time payments, and to improve their treasury operations. TrueLayer will leverage Airwallex's global payments and financial infrastructure API to build new products and services on a global scale. With this collaboration,

How PayTo and Open Banking Can Help Small Businesses in Australia

Woolworths has recently announced that it will be moving payments on to Australia’s real-time payments system, PayTo. This is a major move for the supermarket giant, and it could have a significant impact on the way small businesses operate in Australia. PayTo is a new payment system that allows businesses to accept real-time payments directly from customer bank accounts. This is in contrast to the current system, which relies on Mastercard and Visa credit or debit cards. There are a number of