The Latest from Growpay

Growpays outlook on the future of payments.

Adyen Data Connect for Marketing: Personalize marketing and boost loyalty

Omnichannel businesses are constantly looking for ways to improve their marketing initiatives and provide a better customer experience. One way to do this is by leveraging Adyen's payments data capabilities via Data Connect for Marketing. Data Connect for Marketing is a new product from Adyen that enables businesses to do just that. By connecting payments data across channels, businesses can gain a deeper understanding of their customers and create more personalized and relevant experiences. “

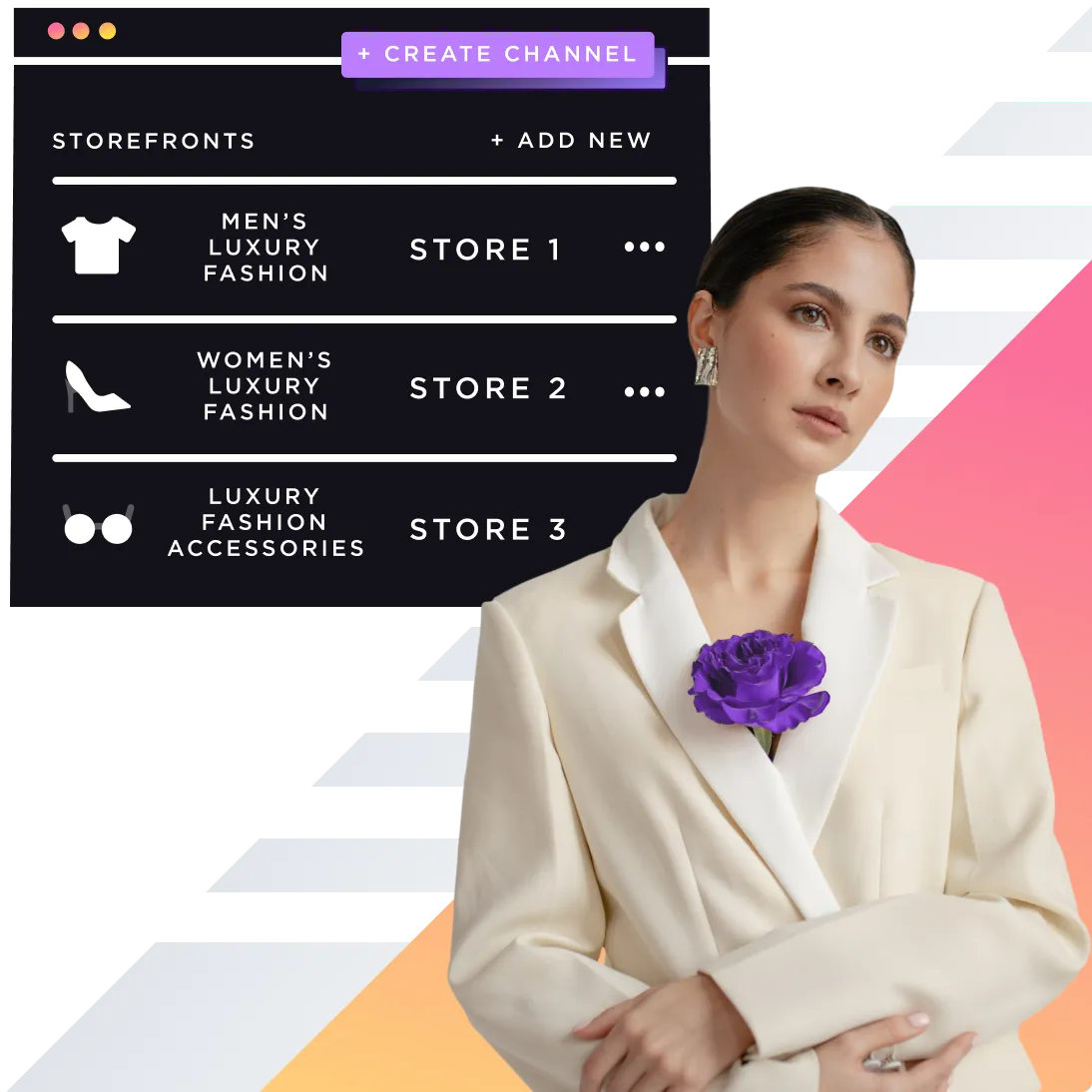

BigCommerce Makes it Easier for Merchants to Accept Localised Payments

BigCommerce, a leading Open SaaS ecommerce platform, has announced new international enhancements for its multi-storefront (MSF) offering. These enhancements will allow merchants to create localised shopping experiences for their customers, regardless of where they live, what language they speak, or what currency they use. One of the key benefits of these new enhancements is that they will make it easier for merchants to accept payments from customers in different countries. BigCommerce will no

SAP and Visa partner to digitise B2B Payments in Asia-Pacific

SAP and Visa announced earlier in the week a partnership to digitise business-to-business (B2B) payments in Asia-Pacific. The partnership will see Visa embed its payments capabilities into the SAP ecosystem, making it easier for businesses of all sizes to make and receive payments. The collaboration will use SAP's Business Technology Platform (SAP BTP) to provide a secure and innovative platform for B2B payments. SAP BTP will allow Visa to deliver its suite of commercial and money movement solu

PayPal and Venmo Introduce Tap to Pay for Small Businesses in the U.S.

PayPal and Venmo today announced the rollout of Tap to Pay for small businesses in the U.S., a new feature that allows businesses to accept contactless payments directly on their Android mobile devices with no additional hardware or upfront cost. Tap to Pay is a secure and convenient way for customers to pay for goods and services. With Tap to Pay, customers simply tap their credit or debit card or digital wallet on the back of a merchant's mobile device to complete a payment. The rollout of T

Pay by Bank: How Businesses Can Save Money and Reduce Fraud

Open banking is a new technology that allows banks to share customer data with third-party companies. This data can be used to create new and innovative payment products, such as pay by bank. Pay by Bank is a method of payment that allows customers to make payments directly from their bank accounts. This is done by using the customer's online banking credentials to authorize a payment. There are a number of advantages to using Pay by Bank. Firstly, it is more secure than traditional payment me

The Complete Guide to Recurring Payments for Businesses

Recurring payments are a convenient and efficient way for businesses to collect payments from customers. They can also help businesses improve customer retention and build trust. In this blog post, we'll discuss what recurring payments are, how they work, and the benefits and drawbacks of using them. What are recurring payments? A recurring payment is a payment that is automatically processed on a regular basis. This could be weekly, monthly, quarterly, or even annually. Recurring payments ar

The Importance of Streamlined Business Payments: How to Improve Efficiency and Reduce Costs

As a business owner or manager, you know that cash flow is critical to the success of your company. One of the most significant factors that can impact cash flow is the efficiency of your payment processing systems. If your business payments are not streamlined, it can lead to delays, errors, and increased costs. In this blog post, we will explore the importance of streamlined business payments and provide some tips on how you can improve efficiency and reduce costs. Why Streamlined Business P

The Pros and Cons of Using Stripe Alternatives for Processing

When it comes to payment processing, Stripe has become the go-to choice for many businesses due to its ease of use, security, and scalability. However, there are also several alternatives to Stripe that businesses can choose from. In this blog post, we will explore the pros and cons of using Stripe alternatives for payment processing. Pros of Using Stripe Alternatives 1. Lower Fees One of the most significant advantages of using a Stripe alternative is the possibility of lower fees. Stripe's

The Benefits of Buy Now Pay Later: A Guide to Afterpay, Klarna, Affirm, and Zip

The rapid advancement of the digital age has brought about significant changes in consumer shopping habits. One such change is the emergence of Buy Now Pay Later (BNPL) services, revolutionizing the way people shop online. With the global BNPL market expected to reach $309.2 billion by 2023, this innovative payment method is projected to grow at a CAGR of 25.5% from 2023 to 2027. In this blog post, we will explore the concept of Buy Now Pay Later, delve into how it works, and highlight the benef