The Latest from Growpay

Growpays outlook on the future of payments.

NAB launches digital wallet-enabled virtual corporate cards

NAB has announced today the launch of its digital wallet enabled virtual corporate cards. NAB corporate cards can help businesses streamline, modernise, and simplify their expenses. It allows businesses to create virtual cards on demand for employees and contractors to use in apps, online, or in store, no matter their location. Additionally, these cards can be used with digital wallets such as Apple Pay or Google Pay. “There’s one thing our customers can never get enough of – time. So, we’re r

Adyen partners with Plaid to offer Pay by Bank

Adyen has partnered with Plaid, to launch its Pay-by-Bank services in North America in early 2024. This partnership will bring a new, convenient, and secure payment method to businesses and consumers in the region. “Plaid’s innovative, industry-leading financial technology made this partnership a great fit,” said Davi Strazza, President of North America. “Our complementary offerings together form an unparalleled Pay-by-Bank experience for businesses and end-consumers alike. This alternative pay

MoonPay and Mastercard partner to accelerate Web3 adoption

MoonPay, a leading cryptocurrency payment provider and Mastercard, a global payments technology company, have announced a strategic partnership to explore opportunities within the evolving Web3 ecosystem while enhancing customer loyalty. The partnership will focus on two key areas: * Enhancing experiential marketing - MoonPay and Mastercard will work together to explore how Web3 tools can be used to enhance experiential marketing and connect with consumers in new ways. This could include usin

Square launches Tap to Pay on iPhone in Australia

Square today launched Tap to Pay on iPhone in Australia, making it the first market outside of the US where Square will offer the technology to its sellers. Tap to Pay on iPhone lets sellers of all sizes accept contactless payments directly from their iPhone, with no additional hardware required and at no additional cost. “Australian businesses are incredibly tech savvy and are always looking for solutions that can make running their business easier,” said Marco Lamantia, Executive Director of

Zeller launches Tap to Pay on iPhone for Merchants

Zeller announced the launch of Tap to Pay on iPhone for merchants. This exciting new feature allows businesses to accept contactless payments using only their iPhone and the Zeller App, no additional hardware required. Tap to Pay on iPhone is a fast, secure, and affordable way to accept contactless payments, including contactless credit and debit cards, Apple Pay, and other digital wallets. At checkout, merchants simply prompt the customer to hold their contactless payment device near the merch

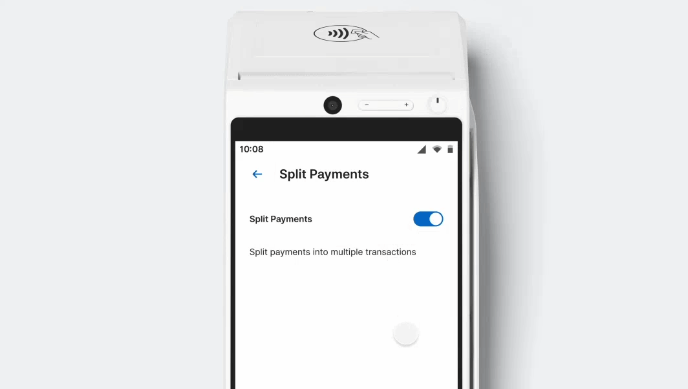

Split Payments with Zeller Terminal

Zeller, the Australian fintech revolutionising business banking, has announced the launch of Split Payments on its Zeller Terminal. This highly anticipated feature allows customers to split payments evenly by the number of diners or by a custom value, making it easier and more convenient to settle group bills. Split Payments offers a number of benefits for both merchants and customers. For merchants, Split Payments can help to reduce risk and increase sales. For example, if a customer doesn't h

Adyen Launches Tap to Pay on iPhone in Australia

Adyen, a global payments platform, has announced the launch of Tap to Pay on iPhone in Australia. This innovative technology allows merchants to accept contactless payments using only an iPhone and a supporting iOS app, without the need for any additional hardware or payment terminal. To use Tap to Pay on iPhone, merchants simply prompt the customer to hold their contactless payment device near the merchant's iPhone. The payment is then securely completed using NFC technology. Tap to Pay on iPh

Mastercard and Oracle Partner to make B2B Payments Easier

Mastercard and Oracle have announced a new partnership to help enterprise customers automate end-to-end business-to-business (B2B) payment transactions. The partnership will allow Oracle to directly connect Oracle Fusion Cloud Enterprise Resource Planning (ERP) with banks to streamline and automate the entire B2B finance and payment process. The partnership aims to address the challenges faced by many companies in making commercial payments, such as disparate data, systems, and processes. By le

What Is Payment Orchestration?

As the world becomes increasingly digital, the way we make payments is also evolving. Traditional payment processes are being replaced by more efficient and integrated solutions. One such solution is payment orchestration, a term that may be unfamiliar to many but is crucial for businesses operating in the digital realm. In this blog post, we will delve into the concept of payment orchestration, its importance, key components, implementation strategies, and future trends. Whether you are a busi